In preparation for the Corporate Sustainability Reporting Directive (CSRD) 2025, Sidetrade has prioritized transparency by publicly detailing the progress of its CSR initiatives. This year, Sidetrade not only continued its commitments but also received recognition for its ongoing improvements in environmental and social governance: a Gold Medal from EthiFinance and a Silver Medal from EcoVadis.

This announcement follows Sidetrade’s success in reducing carbon emissions by 5% in 2023 while revenue grew by a strong 20% over the same period (see press release of July 3, 2024). These achievements highlight the company’s commitment to both corporate growth and planetary stewardship.

Sidetrade stands at the confluence of productivity for businesses and sustainability. Our business goals are now indistinguishable from our commitment to societal well-being, stated Sidetrade CEO Olivier Novasque. We’re advancing towards a future where business integrity and environmental responsibility are not just aligned, but intertwined. As a SaaS software vendor, we are privileged to play a role in contributing to the tech industry’s commitment to the goals of the Paris Agreement and the European Union’s ambitions for carbon neutrality by 2050.

By incorporating the United Nations Sustainable Development Goals (SDGs) into its operations, Sidetrade is implementing initiatives with a global impact:

- Climate action and clean energy: Dedicated to reducing its carbon footprint and enhancing sustainability practices.

- Innovation and equality: Advocating for policies that support talent development across genders and fostering innovation.

- Digital responsibility and ethical practices: Upholding robust standards for digital behavior and ethical business practices.

Philippe Gangneux, Sidetrade’s CFO and CSR Ambassador said: Our approach for the future can be distilled into two words: demanding and ambitious. Every decision and innovation at Sidetrade is aimed at amplifying our positive impact on both our community and the environment.

Sidetrade invites stakeholders to review its comprehensive CSR report to better understand how it melds financial success with far-reaching social and environmental impact: here.

Olivier Novasque, CEO of Sidetrade commented:

This first half of the year saw us deliver our best performance to date, with robust bookings – up 25% in Annual Contract Value – and never-before-seen revenue for a half year, close to the €25 million mark, representing a 19% increase. On top of these record bookings, which will generate more than €7 million in additional revenue for the coming year, it’s how we accomplished this performance that gives us signs of encouragement as we look to the quarters ahead. Above all, we must highlight our consistent results in two consecutive quarters with binding contract commitments averaging 45 months for our large accounts, despite current macroeconomic uncertainty. Our growth driver is now almost perfectly balanced between the United States and Europe, with each region accounting for 45% and 55% of bookings. Though France represents 31% of total bookings, its contribution must be relativized over time. Lastly, despite the fact that Q3 is traditionally the weakest period for bookings, assuming this trend continues into H2 2024, it would only further enhance the robustness of our economic model which – as a reminder – is 90%-based on recurring revenue.

In revenue terms, Sidetrade turned in an excellent half-year performance, aligning with 2023 and posting growth of 19%. This double-digit figure is driven both by our expansion in the United States (+40%) and by a significant increase in our subscription revenue with multinationals generating $2.5 billion-plus revenue (+34%). With more than 60% of our revenue now achieved through international markets including 32% in North America, combined with 90% recurring revenue and an increasingly powerful growth driver, Sidetrade is showcasing its robust development strategy against an uncertain economic and geopolitical backdrop. The ongoing acquisition of SHS Viveon AG in Germany means that we are in pole position to cement our global leader status in the Order-to-Cash market and to execute our Fusion100 strategic plan, targeting $100 million in revenue by the end of 2026.

All-time performance for half-year bookings: ACV up 25%

| Sidetrade (m€) |

H1 2024 | H1 2023 | Change |

| New SaaS subscriptions (New ARR) | 3.95 | 3.30 | +20% |

| Services bookings | 3.47 | 2.62 | +32% |

| New Annual Contract Value (ACV) | 7.42 | 5.92 | +25% |

2024 information is from consolidated, unaudited data.

In H1 2024, Sidetrade set another record for bookings, adding €7.42 million in new Annual Contract Value (ACV) versus €5.92 million in H1 2023, representing a substantial increase of 25%. It should be noted that H1 2023, which saw growth of 21% versus H1 2022 (€4.81 million), already turned in the Company’s best performance to date in ACV terms, representing a challenging base effect. On balance, between H1 2022 and H1 2024, Sidetrade reported an increase of more than 54% in its ability to win new bookings.

This first-half performance is partly due to the Company’s success in North America since it represents new ACV of €3.34 million, accounting for 45% of total bookings. Sidetrade’s development model now shows a near-perfect balance between North America (45%) and Europe (55%). Within Europe, France accounted for 31% of total bookings, serving as a relative contributor to Sidetrade’s future growth.

In H1 2024, the initial contract period for new customers (excluding renewals) rose to 45 months (vs. 44.8 months a year earlier), considerably above SaaS industry peers who generally run contract periods between 24 and 36 months. This is a clear testament to new customers’ confidence in Sidetrade’s solutions despite prevailing economic and political uncertainties. Looking to the quarters and years ahead, new customers’ binding contract period serves to increase the Company revenue model’s predictability and resilience.

New SaaS bookings (New ARR) totaled €3.95 million, up 20% on H1 2023 (€3.30 million), reaching an unprecedented level for a first half in Sidetrade’s history, even though Q2 2023 remains the best-performing single quarter to date in terms of bookings. Q1 and Q2 2024 recorded more regular and steadier new SaaS bookings compared to the same periods last year, posting €1.85 million (Q1 2024) and €2.10 million (Q2 2024) versus €0.89 million (Q1 2023) and €2.41 million (Q2 2023).

Overall, in H1 2024, Total Contract Value (TCV) increased to €12.24 million versus €10.87 million a year earlier.

Parallel to this, services bookings, with almost all invoiced within 12 months of their signing, totaled €3.47 million for the first half of 2024, up 32% on the same period the previous year (€2.62 million). This strong increase is still attributed to the multiplication of global projects, in line with the successful business strategy kick-started 24 months ago, targeting accounts generating $1 billion-plus revenue.

In H1 2024, bookings by new customers (“New Business”) accounted for 64% of the total. Cross-selling for new entities within a Group and/or the sale of other main applications in Sidetrade’s Order-to-Cash suite, including CashApp, Credit Risk Expert and e-Invoicing, represented 19% of total new bookings. Lastly, the remaining 17% of bookings were driven by Upselling of additional modules to existing customers.

For the third year running, Sidetrade was recognized as a Leader in the prestigious Gartner® Magic Quadrant™ for Invoice-to-Cash applications. This distinction acknowledges the expertise of Sidetrade’s Integrated Invoice-to-Cash applications, reflecting the Company’s advancements in artificial intelligence (see press release of May 8, 2024). Quarter after quarter, Sidetrade consolidates its leadership in the global Order-to-Cash market.

This first-half 2024 performance reflects the upward trend in bookings observed during the 2023 fiscal year, further validating the relevance of the Company’s strategic decisions, namely: 1/ a business strategy kick-started 24 months ago, with a focus on companies generating $1 billion-plus revenue, 2/ an increased recognition by multinationals of Sidetrade’s technological edge in AI, particularly in the United States, and 3/ the development of a comprehensive Order-to-Cash software suite resulting from a strategy of continuous innovation.

Strong revenue increase of 19%, with SaaS subscriptions up 18%

| Sidetrade (m€) |

H1 2024 | H1 2023 | Change |

| Order-to-Cash SaaS subscriptions | 20.5 | 17.4 | +18% |

| H1 Revenue | 24.8 | 20.9 | +19% |

2024 information is from consolidated, unaudited data.

In H1 2024, Sidetrade reported strong growth in revenue for Order-to-Cash SaaS subscriptions, up 18%.

The Company’s revenue for the first half of 2024 totaled €24.8 million, also reporting an increase of 19%. On a Group-wide basis, this double-digit growth is attributable to:

- Robust revenue growth in the United States, up 40%

Quarter after quarter, the United States is a growth driver for Sidetrade, posting revenues up 40% to €7.9 million in H1 2024. International markets account for 60% of the Company’s total revenue, with 32% coming from North America. Going forward, the United States will continue to be pivotal for Sidetrade’s growth. - Ever-increasing demand from multinational corporations

Analysis of customer profiles is underpinned by growth of 34% in subscriptions with multinational corporations on annual recurring revenue (ARR) contracts in excess of €250,000. These subscriptions now account for 47% of Sidetrade’s total subscriptions and are expected to remain an important growth driver in the quarters ahead. - Consolidation of CreditPoint Software business

Effective July 1, 2023, the consolidation of the CreditPoint Software business has positively contributed to Sidetrade’s performance. In H1 2024, CreditPoint generated revenue of €0.8 million, with a 4% impact on quarterly growth.

It should be noted that all multi-year Sidetrade contracts are routinely indexed to inflation (the Syntec for Southern Europe, the UK CPI for Northern Europe and the US CPI for the United States). This measure alters the total price of SaaS subscriptions each year by reference to changes in these price indices, without anticipating contract renewals.

Double-digit growth in sales confirmed for 2024

On the back of an outstanding first-half performance, the Group’s management is confident in Sidetrade’s ability to deliver double-digit growth in the 2024 fiscal year.

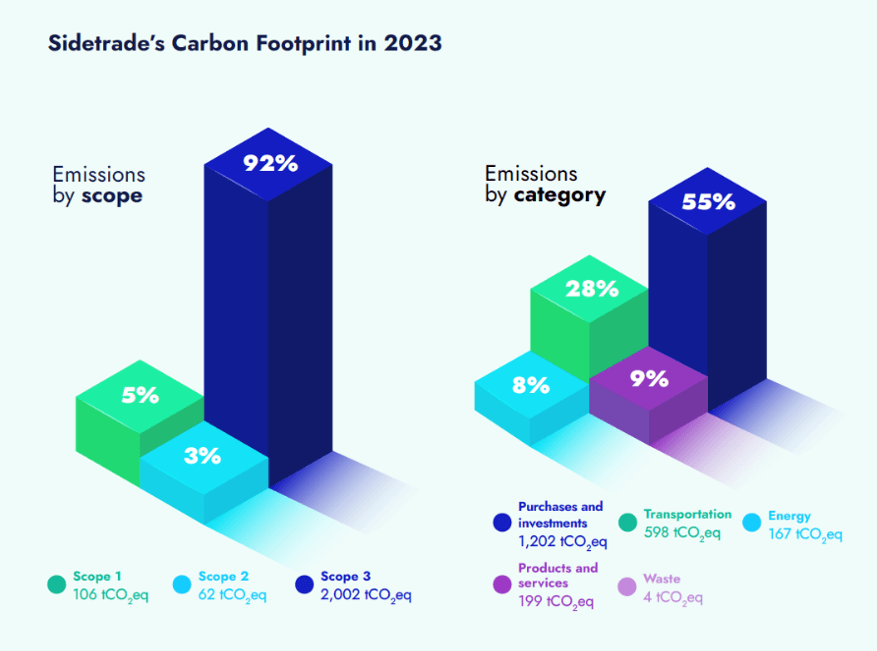

Utilizing the certified Bilan Carbone® methodology, Sidetrade analyzed the emissions across its entire operational scope, encompassing France, the UK, Ireland, Canada, and the USA. With a strategy to manage carbon emissions across scopes 1, 2, and 3, Sidetrade has focused on responsible purchasing, prudent use of digital technology, sustainable internal practices, and eco-friendly mobility solutions.

With a carbon footprint of 2,170 tons of CO2 equivalent for 2023, Sidetrade reduced its emissions by 5% from 2022. This achievement is particularly notable given the company’s simultaneous 20% revenue growth at constant exchange rates. The positive contrast highlights the effectiveness of Sidetrade’s energy-saving measures, demonstrating its dedication to sustainability alongside financial success.

Sidetrade’s carbon intensity performance not only aligns with the industry standard but also sets a benchmark for excellence, as highlighted in a 2023 comparative study by Eiffel Investment Group based on Ethifinance ESG Ratings data, said Emilie da Silva, Managing Director at Eiffel.This achievement underscores their commitment to environmental responsibility while excelling in a competitive market, proving that sustainability and success can thrive together.

Sidetrade made significant strides by optimizing its IT infrastructure management and reducing server energy consumption, cutting scope 3 emissions to 2,002 tons of CO2 equivalent — a 7% decrease from 2022.

By reducing our carbon footprint by 5% while simultaneously achieving a 20% revenue growth, we’ve demonstrated that environmental and financial performance can go hand in hand. We take an impact-based approach to the development of our AI solutions, designed to minimize our impact on the environment whilst also maximizing value delivered for our customers, said Philippe Gangneux, CFO and CSR Ambassador of Sidetrade. Companies with a commitment to CSR are not only better positioned to meet the ecological expectations of stakeholders but also tend to outperform those that do not prioritize sustainability.

Recognizing that the journey towards a sustainable future is ongoing, Sidetrade remains steadfast in its commitment to controlling emissions, both now and in the future. As the company looks ahead, it continues to focus on scope 3 emissions, aligning its efforts with stakeholders’ ecological expectations and strengthening its dedication to environmental protection.

Allison Barlaz joins Sidetrade with over twenty-five years’ experience in product and marketing roles across software companies, including SaaS vendors. In her new role, Barlaz provides visionary leadership and strategic marketing direction, contributing to Sidetrade’s expansion goals. She joins the executive committee of Sidetrade, expanding its membership to 10.

Allison joins us at milestone moment for Sidetrade as it steers through significant Gen AI transformations said Olivier Novasque, CEO of Sidetrade. Her success building B2B brands coupled with her martech expertise is pivotal in our market reach and new growth initiatives.

Barlaz has a proven track record in demand generation, leveraging new marketing technologies to support business objectives and drive revenue growth. In addition, she has experience in the Order-to-Cash market, having spearheaded BlackLine’s demand generation and digital marketing strategy for more than two years.

Commenting on her new role, Barlaz said: It’s an exciting time for the Order-to-Cash market as the impact of AI technology becomes more evident each day. Sidetrade is well positioned to help clients realize this untapped value, as demonstrated by our three-time positioning as a Leader in the Gartner® Magic QuadrantTM for Invoice-to-Cash Applications. I am excited to contribute to this market leader and help drive its next phase of growth globally.

Barlaz is based in the US and holds degrees from INSEAD Business School, UC Berkeley, and the University of Pennsylvania, underscoring her formidable background and readiness to lead Sidetrade’s marketing endeavors.

Gartner, “Magic Quadrant for Invoice-to-Cash Applications”, Tamara Shipley, Valeria Di Maso and Miles Onafowora, May 6, 2024.

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally, and MAGIC QUADRANT is a registered trademark of Gartner, Inc. and/or its affiliates and are used herein with permission. All rights reserved.

Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

New management at SHS Viveon AG as Sidetrade takes majority control

Sidetrade AG, a wholly owned subsidiary of Sidetrade group, has now secured 1,977,439 shares, representing 79.39% of SHS Viveon AG’s outstanding share capital, thereby becoming the majority shareholder.

On June 4, 2024, Olivier Novasque, CEO of Sidetrade, was appointed as the new CEO of SHS Viveon AG: I’m excited to lead the SHS Viveon team of talented employees who bring with them impressive expertise and skills in risk management. Together, we will innovate, reach new heights, and continue to serve our valued customers in Germany and beyond with passion.

In conjunction with this appointment, the Supervisory Board of SHS Viveon AG implemented further significant changes on June 10, 2024. Philippe Gangneux, CFO of Sidetrade, was appointed the new Chairman of the SHS Viveon AG Supervisory Board. Mark Sheldon, CTO of Sidetrade, was named as a new Board member, joining Heinz Resch, who remains as Deputy Chairman.

SHS Viveon AG delisting approved by Munich Stock Exchange

SHS Viveon AG (ISIN: DE000A0XFWK2) has formally applied to delist its shares from the Munich Stock Exchange. The Munich Stock Exchange decided that the listing on the m:access segment will end on June 30, 2024 and on the regulated unofficial market “Freiverkehr” on November 15, 2024. As a result, after November 15, 2024, SHS Viveon shares will no longer be listed on the capital markets.

In accordance with Munich Stock Exchange, Sidetrade has extended its public tender offer to July 29, 2024 at midnight (CEST, Munich, Germany). This extension provides SHS Viveon’s shareholders with ample time to tender their remaining shares. As stated in the May 2, 2024 press release, Sidetrade’s offer price is €3.00 per SHS Viveon share in cash.

SHS Viveon AG delisting time-frame

| May 7, 2024 | Tender offer opens |

| June 12, 2024 | Delisting of SHS Viveon AG proposed to the Munich Stock Exchange |

| June 17, 2024 | End of the initial tender offer period |

| June 24, 2024 | Extension period of the tender offer opens |

| June 30, 2024 | Delisting of SHS Viveon AG from m:access |

| July 29, 2024 | End of the tender offer period at midnight (CEST Munich, Germany) |

| November 15, 2024 | Delisting of SHS Viveon AG from “Freiverkehr” |

The tender offer is not subject to reaching a minimum acceptance threshold.

The tender offer documentation is available on www.sidetrade.com in German (https://www.sidetrade.com/wp-content/uploads/2024/05/public-tender-offer-shs-viveon-de.pdf) and in English (https://www.sidetrade.com/wp-content/uploads/2024/05/public-tender-offer-shs-viveon.pdf).

Copies of the German language binding document may be obtained at uebernahmeangebot@oddo-bhf.com.

Sidetrade is assisted by King & Spalding LLP as legal advisor on the transaction and ODDO BHF SE as financial advisor.

About SHS Viveon AG, a German leader in credit risk & compliance management software applications

Founded in 1991 and headquartered in Munich, Germany, SHS Viveon AG offers applications designed to enable risk, credit, and compliance management teams to automatically identify, assess, and hedge risks in a flexible, digital process. It simplifies access to all relevant data from any system, improves analysis and simulation, and enables better business decisions.

In 2023, SHS Viveon AG reported revenues of €8.8 million. SHS Viveon AG’s customer portfolio currently comprises 80 businesses including Fortune 100 companies.

Olivier Novasque, CEO of Sidetrade commented: Leaders around the world understand that generative AI is the new frontier for driving business transformation and unexpected growth. At Sidetrade, we are at the forefront of this exciting and rapidly evolving field. Our dedication to innovation is reflected in the solutions and the growth opportunities we create for our wemployees, customers and shareholders.

Our ambition is to revolutionize the Order-to-Cash landscape. By leveraging generative AI and the world’s only real time O2C Data Lake, we are going to reshape industry benchmarks, raising the bar to a level never seen before. We are changing the game for finance teams’ operations allowing them to reach unexpected performance. Our AI, AKA Aimie, unlocks new potential by mastering GenAI efficiency. Aimie processes over $6.1 trillion worth of O2C payment experiences to provide the best performance recommendation every second, surpassing the capabilities of static ERP systems, spreadsheets, rule-based O2C software and even, advanced but too generic ChatGPT abilities. Our mission is to empower finance professionals in their daily life by delivering them not only intelligent automation but the highest level of intelligence in their cash conversion performance across their entire Order-to-Cash journey.

Introducing ‘Ask Aimie’ – Sidetrade’s first generative AI feature

Recently, Sidetrade introduced ‘Ask Aimie’ within the Digital Case solution, the first generative AI feature revolutionizing user experience. This new innovation provides users with concise summaries of lengthy emails from their clients and enables them to generate appropriate replies by choosing from four different templates; this functionality, enables to respond promptly and effectively, maintaining the context throughout the communication.

With ‘Ask Aimie’, finance teams benefit from:

- Streamlined efficiency: Reduced time spent on information gathering and email drafting, freeing up resources for higher-value tasks.

- Enhanced communication: Faster and more personalized customer interactions.

- Improved comprehension: An enriched reading experience with real-time contextual information, helping users understand content without the need for external research.

- Instant insights: Immediate access to a wealth of O2C information, setting new benchmarks in AI predictability, accuracy, transparency, explainability, and user customization.

Rob Harvey, Chief Product Officer of Sidetrade commented: It’s been a quarter of a century since search engines like Google democratized access to universal knowledge. However, it was still up to us to interpret results and create relevant, specific, and accurate content from them. Today, generative AI answers users’ problems on specialized topics, offering invaluable support even in complex environments. But the benefits of generative AI extend far beyond just producing well-written content. Domain expert LLMs we are leveraging can be fine-tuned to deliver responses that not only exhibit human-like reasoning but also demonstrate a deep understanding of finance and its context. This approach builds trust with users and adds value for our customers.

Our AI, Aimie, mimics human-like reasoning by analyzing billions of transactions in seconds and focusing on the complex context of the customer and their environment. This makes her the most advanced O2C Intelligent Agent on the market. She acts as a mirror, reflecting current customer interactions and revealing blind spots and weaknesses through real time, data-driven insights: Aimie is a superb assistant for text recognition and generation. This enables organizations to enhance relevance, better understand context, and optimize customer responses, ultimately improving customer satisfaction. By freeing up finance teams, sales, and customer services to tackle more complex issues, Aimie further enhances customer satisfaction.

Deploying generative AI technology will allow Sidetrade’s customers to streamline their customer interactions, accelerate their understanding, and personalize their responses for a more human touch.

Combining GenAI with worldwide data to set new standards in Order-to-Cash

Sidetrade’s AI Aimie utilizes machine learning (ML) techniques to analyze customer payment behaviors. Since 2015, Sidetrade has built the most advanced and vast dataset in the Order-to-Cash market, and the only one offering real time AI capabilities. Continuously learning from Sidetrade’s extensive Data Lake, Aimie has been able to recommend optimal collection strategy and act by her own on certain actions. Now, Sidetrade has integrated a new range of data science techniques with the development of its own generative architecture which integrates Large Language Models (LLMs) that are being trained on vast amounts of O2C text data to understand and generate complex human language specific to the industry.

These latest technologies enable Aimie to analyze and understand natural language queries, generate relevant answers, and assist users in anticipating future payment behaviors based on emerging trends and current data. Aimie also leverages big data elements to process and analyze large quantities of Data Lake information, elevating its capability to deliver relevant, accurate, contextualized O2C specific insights that no other vendor can provide.

Mark Sheldon, Chief Technology Officer at Sidetrade: With the O2C industry’s most advanced and only real time Data Lake, Sidetrade is uniquely positioned to capitalize on the potential of generative AI because without data, there is no advanced AI. Sidetrade offers unparalleled insights to customers worldwide, empowering finance professionals to benefit from GenAI. This leads to strategic business growth and operational efficiency in ways previously unattainable. Generative AI places humans back at the heart of processes, without sacrificing performance objectives.

Ensuring data privacy and customization with in-house innovation of LLMs

The advantage of running Sidetrade’s own generative architecture with domain expert LLMs, over generic, third-party hosted LLMs, is that Aimie provides insights that are far more tailored and specific to the O2C industry. Unlike GenAI features on the market that offer much more generalist information, Sidetrade’s AI delivers precision and relevance.

Moreover, unlike other SaaS offerings, all of Sidetrade’s infrastructure, LLMs, and data remain within Sidetrade’s private cloud. This ensures that customer data is fully segregated and never mixed in with external models, prioritizing privacy and security.

Sheldon continued: Sidetrade’s approach to generative AI ensures that our technology upholds the highest standards of privacy, sovereignty, and accuracy. Instead of adopting a plug-and-play approach, we have built an entire ecosystem in-house, taking full ownership of the intellectual property. This strategy offers a whole host of benefits to our customers, both now and in the future, including a more bespoke, customized and accurate service. Additionally, it provides the reassurance that their data never leaves our secure cloud environment.

According to Gartner (source: Magic Quadrant Research Methodology | Gartner), “Leaders execute well against their current vision and are well positioned for tomorrow.”

Sidetrade Chief Product Officer, Rob Harvey said:Being named as a Leader by Gartner for the past three years is a remarkable recognition for us. At Sidetrade, we take pride in our commitment to innovation, and we believe this recognition reflects our advancements in artificial intelligence and the value we create for our clients.

At a time when AI tends to be seen as a commodity, the differentiating factor is the quality of the data. The reason is simple: there is no high-performance AI without data. Sidetrade’s AI – nicknamed Aimie – stands out with its exclusive access to the Sidetrade Data Lake, allowing her to mine a vast source of financial and business data. This unique capacity gives Aimie exceptional accuracy in analyzing payment behaviors and predicting the dynamics of cash flow generation. Aimie is continuously enriched with millions of data points, leveraging the latest in machine learning, natural language processing and, more recently, generative AI. The power of our AI, fueled by our Data Lake, demonstrates our advanced expertise in algorithms.

From Sidetrade’s perspective, being recognized as one of the vendors positioned in the Leaders Quadrant in the 2024 Gartner Magic Quadrant acknowledges its AI capabilities, product strategy and customer support.

Sidetrade Chief Executive Officer, Olivier Novasque said:Being named a Leader in the Gartner Magic Quadrant for Invoice-to-Cash Applications for three years in a row means a lot to us, and it’s fantastic to be recognized for both our ability to execute and completeness of vision. It offers credibility and visibility in competitive markets but also trust among large global organizations, demonstrating Sidetrade’s reliability and effectiveness. Additionally, we believe this recognition supports Sidetrade’s expansion efforts, helping to establish a strong foothold and attract new business, in particular in North America.

Download a copy of this 2024 Gartner Magic Quadrant report, here.

Source Gartner, “Magic Quadrant for Invoice-to-Cash Applications”, Tamara Shipley, Valeria Di Maso and Miles Onafowora, May 6, 2024.

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally, and MAGIC QUADRANT is a registered trademark of Gartner, Inc. and/or its affiliates and are used herein with permission. All rights reserved.

Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

As announced in the May 2, 2024 press release, Sidetrade’s tender offer for SHS Viveon AG has been posted in the Federal Gazette, an official promulgation and announcement organ of the Federal Republic of Germany, today. The price of this friendly offer is €3.00 per SHS Viveon share in cash.

Planned milestones for Sidetrade’s acquisition of SHS Viveon AG

| May 7, 2024 | Tender offer opens |

| May 9, 2024 | Delisting of SHS Viveon AG proposed to the Munich Stock Exchange |

| June 17, 2024 | Tender offer closes |

The tender offer is not subject to reaching a minimum acceptance threshold.

The tender offer documentation is available on www.sidetrade.com in German (https://www.sidetrade.com/wp-content/uploads/2024/05/public-tender-offer-shs-viveon-de.pdf) and in English (https://www.sidetrade.com/wp-content/uploads/2024/05/public-tender-offer-shs-viveon.pdf).

Copies of the German language binding document may be obtained at uebernahmeangebot@oddo-bhf.com.

Sidetrade will support the delisting of SHS Viveon AG’s shares from the open market m:access of the Munich stock exchange. Post delisting, SHS Viveon AG shares will not trade anymore in Germany (either Frankfurt or Munich).

Sidetrade is assisted by King & Spalding LLP as legal advisor on the transaction and ODDO BHF SE as financial advisor.