Augmented Cash

Powered by Sidetrade’s award-winning AI technology, Augmented Cash is a cash and credit management software solution. Using intelligent process automation and predictive analytics for the most effective collection strategies, Sidetrade helps businesses get paid faster through the Order-to-Cash process.

Augmented Cash streamlines and automates the Order-to-Cash process. Thanks to Aimie!

Most powerful Order-to-Cash automation

Augmented Cash is a unique, holistic and comprehensive AI software solution that complements businesses’ whole Order-to-Cash journey. Augmented Cash is the most powerful RPA and AI platform using machine learning, modelling, and process automation for faster and more trustworthy cash generation through Order-to-Cash.

Consider Aimie as your new Order-to-Cash virtual assistant in collaborative intelligence, i.e., Artificial Intelligence supports natural intelligence to let accounts receivable teams work faster and smarter.

Data drives Sidetrade’s accounts receivable software

Aimie continuously learns from Sidetrade’s unique database of global customer payment behavior. She delivers actionable insights that enable cash collection teams to make data-driven decisions they can trust.

Why use Sidetrade’s Credit Management Software

Gain a 360-degree view of customer payment behavior

Improve collection efficiency and reduce employees’ workload

Enhance collaboration between sales, finance and delivery

Boost cashflow, improve working capital, and reduce bad debt

Increase customer satisfaction by resolving disputes faster

Gain control and visibility of the Order-to-Cash process

The Best Augmented Cash modules

Cash collection software with Augmented Collection

Sidetrade’s Augmented Collection enables teams to:

- Build proactive collection strategies

- Balance workload for collection agents

- Use predictive insights to solve payment disputes

- Automate query management and qualification

Aimie takes into consideration all available resources to recommend the best collection approaches and the highest probability of success. Sidetrade cash collection software automates routine Order-to-Cash tasks and auto-sorting emails, freeing up time for the cash collectors to focus on more complex value-add actions.

COLLECTIONS MANAGEMENT SOFTWARE

Dispute Management software with Digital Case & Cash Culture

Sidetrade’s Digital Case enables teams to:

- Streamline collaboration across finance and sales

- Speed up time to resolution

- Ensure Service Level Agreements are met

- Prevent future sales being lost or delayed

Aimie helps simplify interactions with customers by accurately filtering up to 70% of dispute-related emails at the point of entry. Aimie recommends a formalized and efficient dispute process, accelerating payment, improving customer satisfaction, and reducing bad debt.

For Salesforce CRM users, the Sidetrade Cash Culture boosts collaboration even further with a real-time window into customer payment dispute history.

Credit Risk Management software

Sidetrade’s Credit Risk Management enables teams to:

- Run business credit checks

- Set appropriate business credit limits

- Manage insurance guarantees

- Establish alerts on warning signs

All available customer data is considered in the process, from internal payment behavior and financial commitments, through to external financial information (e.g., Creditsafe, Ellisphere, Coface, and credit insurers such as Euler Hermes).

With Credit Risk Management, finance and customer-facing teams make timely decisions based on a comprehensive overview of potential financial risk, giving insights for sales negotiations, collection priorities and dispute resolutions.

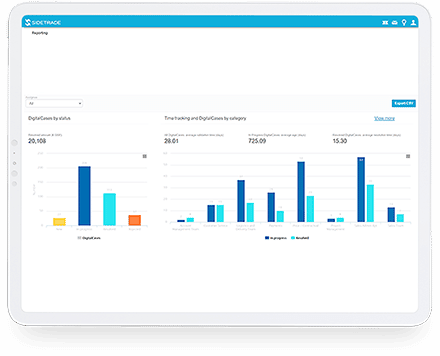

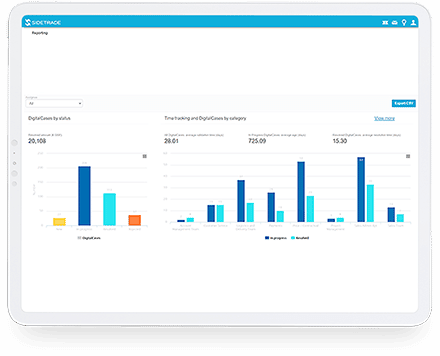

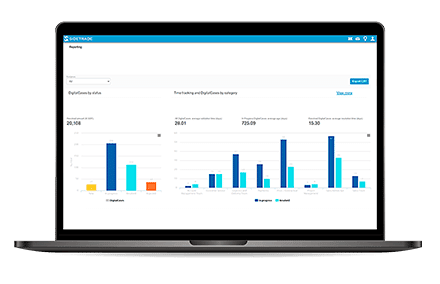

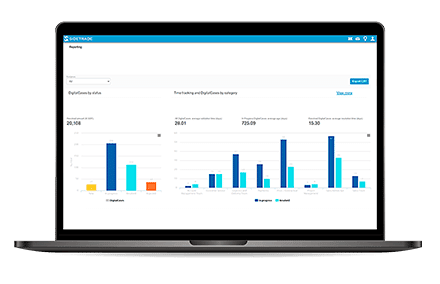

Business Intelligence software for Credit management with Sidetrade Analytics

Sidetrade Analytics increases decision-making capabilities providing a library of plug and play reports and dynamic dashboards (standardized or custom) with real-time financial positions and KPIs (DSO, aging balances, changes in payment behavior, long-term forecasts, credit management, team performance, etc.).

Built on the industry-leading business intelligence data visualization software, Tableau, Sidetrade Analytics reduces the dependence on Excel, and provides full visibility of an organization’s cash position at a global, regional and local level. Dashboards can be extracted and shared to improve cross-company visibility and coordination.