Credit Risk Expert

AI-driven credit onboarding, decisioning, and risk exposure management

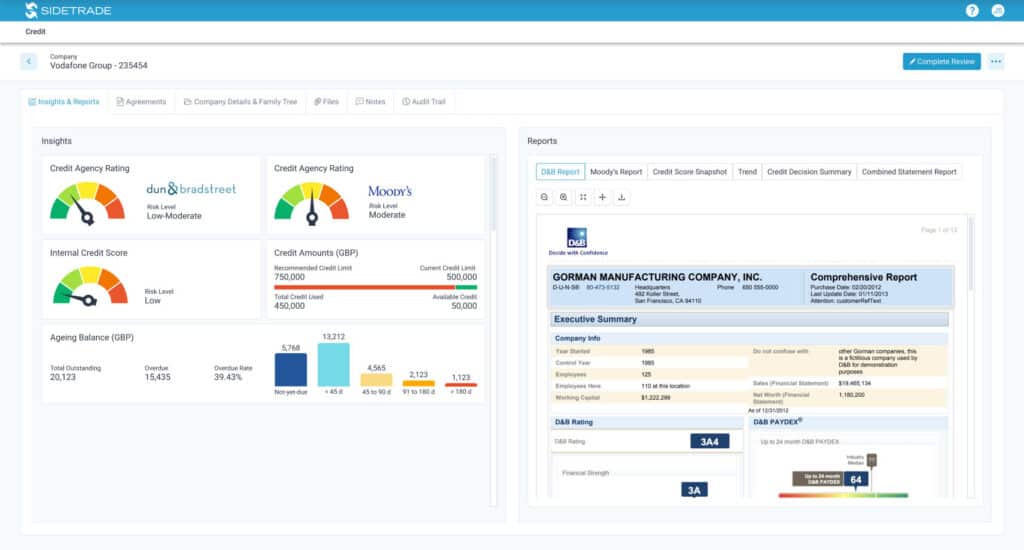

Sidetrade Credit Risk Expert reduces credit risk and drives sales growth by streamlining credit processes and empowering data-driven credit decisions through flexible, customizable workflows. AI-driven credit onboarding, decisioning, and risk exposure management improves efficiency, accuracy, and profitability while reducing risk exposure. Accelerate collections, minimize bad debt and shorten DSO, and expand business with your most valuable customers thanks to Sidetrade’s Credit Risk Expert.

AI-driven Credit Onboarding, Decisioning, and Risk Exposure Management

For companies experiencing rapid growth and facing challenges with manual credit processes, inconsistent risk assessments, and limited visibility, Sidetrade Credit Risk Expert leverages key contextual data and a sophisticated scoring engine to automate effective risk assessment and reliable decision-making processes. Empower your team with real-time data through effortless integrations with credit bureaus, ERP, and CRM systems.

- Gain comprehensive visibility into client portfolios throughout the order-to-cash cycle and expand business with your most valuable customers.

- Simplify credit approvals and streamline customer onboarding to drive sales while minimizing credit, collections, and default risks.

- Enhance team productivity and efficiency, eliminating bandwidth limitations.

Streamline Credit Applications with Sidetrade’s Online Credit Application

Design unlimited customized online credit application templates tailored to your specific business requirements. Establish comprehensive terms and conditions, define mandatory fields, and automate bank and trade reference verifications to guarantee comprehensive data capture. Efficiently evaluate and decide on a higher volume of credit applications, enabling you to achieve more with optimized resources.

Empower Automated Credit Decisioning with Sidetrade’s Decision & Scoring Workflow Engine

Enhance team productivity and free up internal resources by empowering automated credit decision-making with customizable rule-based workflows encompassing decision-making, tracking, and monitoring. Mitigate the risk of human error and ensure consistent, data-driven credit decisions.

Seamless Integrations with Credit Bureaus and Rating Agencies for Comprehensive Credit Risk Insights

Leverage Sidetrade’s seamless integrations with over 20 leading credit bureaus and rating agencies to gain a comprehensive understanding of your credit risk. Enriched by the power of the Sidetrade Data Lake, businesses can harness real-time monitoring and insights to proactively manage risk and make informed decisions with greater confidence.

Real-time Credit Risk Management with Sidetrade

Empower yourself with real-time monitoring and insights to gain the most accurate understanding of credit risk and accelerate financial returns. Sidetrade harnesses key contextual data from credit bureaus and your financial systems, along with sophisticated business rules and algorithms, to automate credit risk assessment and decision-making for B2B enterprises.

Unleash the Power of Sidetrade

Automate all new, renewal, and increase decisions

Deliver an exceptional customer experience

Streamline and accelerate customer onboarding

Mitigate credit risk and minimize potential losses

Deliver real-time, data-driven insights for accurate and informed decisions

Drive top-line revenue by expanding business with your most valuable customers.