In the current climate, it seems that most businesses have finally agreed that the old way of doing things is just not going to cut it anymore. But where do you begin to build an innovation strategy or a culture of innovation? And how can tech help business recovery in a post-covid world? Sidetrade might have the answer.

Sidetrade uses Artificial Intelligence to empower sales, and finance teams to grow sales and accelerate cash. Sidetrade also identifies untapped business opportunities on the customer journey with Aimie, its Artificial Intelligence platform.

Mark Sheldon was appointed group CTO of Sidetrade in July 2019, after the British AI start-up he co-founded, BrightTarget, was sold to Sidetrade. After a consultancy and in-house career in the software and digital transformation space, he now oversees Sidetrade’s global R&D strategy, leads a team of data engineers and data scientists, and oversees the company’s annual Coding Academy for college and university leavers.

Mark also recently opened the company’s newest Tech Hub in the centre of Birmingham, backed by strong investment for new jobs in R&D and community engagement. Mark is also sharing his story and offering his advice for would-be and current entrepreneurs and those looking help grow tech in the West Midlands at the Birmingham Tech Week event.

In today’s episode of Tech Talks Daily, Mark shared his insights around how to anticipate technological evolutions in AI. He discusses how to stay at the forefront of innovation, hiring, and keeping tech talent. Finally, Mark also shares the global R&D recruitment drive at Sidetrade and how listeners can get involved.

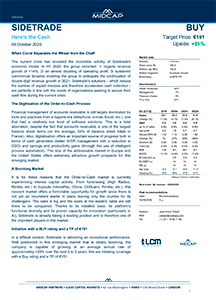

Sidetrade announces expanded coverage of their stock through a support contract with Midcap Partners, a broker and investment bank specialized in small and midcaps. Established in Paris and London, Midcap Partners have the international footprint to strengthen Sidetrade’s visibility, especially with French and British investors.

Charles-Henri Berbain, managing partner and founder of Midcap Partners, had this to say about the deal:

We are delighted to raise Sidetrade’s profile with European, British, and North American investors. Sidetrade is one of the rare SaaS players listed on the Paris Stock Exchange. It has solid growth potential on a booming world market. We have every confidence in the ability of Sidetrade management to go out and conquer.”

The research report, “Sidetrade – Here is the cash” is downloadable at https://www.sidetrade.com/company/investors/. Midcap Partners will publish research notes on Sidetrade, according to the firm’s latest news, and will hold regular meetings with targeted investors.

Sidetrade stock is also covered by the Gilbert Dupont brokerage firm (part of the Société Générale group), who initiated coverage of Sidetrade in July 2009.

* All reports on Sidetrade prepared by analysts represent the opinions of those analysts and not necessarily those of Sidetrade. The information in such reports does not constitute an offer to sell or subscribe, or a solicitation of an offer to buy or subscribe to any security in France, Europe, the United States, or any other country.

23 September 2020

Olivier Novasque, chief executive officer of Sidetrade, had this to say:

The Covid-19 crisis has revealed the soundness of our foundations and our sustained potential for development. Firstly, double-digit first half growth clearly demonstrates the capacity of our SaaS subscription model to withstand even the toughest of crises. Secondly, Sidetrade’s mission- enable companies to secure and generate cashflow- clearly strikes a chord with today’s hard-hit corporate finance departments. Our worldwide success has been powered by farsighted investments, including AI R&D and sales capacity. Despite the crisis, our bookings have never been so high. Emboldened by these results, we will continue our offensive investment policy.

Notwithstanding the economic uncertainties ahead, the robustness of our foundations, the relevance of our solutions, and the boldness of our investments are leading to the best annual performance in Sidetrade’s history, and setting the stage for strong continued growth in 2021 and beyond.”

14% growth in revenue at the height of the pandemic

| SIDETRADE GROUP (MILLION EUROS) |

S1 2020 | S1 2019 | VARIATION (%) |

|---|---|---|---|

| REVENUE | 14.4 | 12.6 | + 14% |

| OPERATING PROFIT | 1.3 | 0.7 | + 94% |

| NET PROFIT | 1.1 | 0.5 | + 103% |

Non-audited 2020 consolidated data.

Following a particularly good Q1 (+14%), Sidetrade kept up the momentum in Q2, with 15% organic growth against the same period in 2019 (sales of €6.6M). Q2 turnover was €7.5m, the highest in the company’s history. H1 revenue reached €14.4 M, up 14% vs. the previous financial year.

More than ever, Sidetrade’s recurrent SaaS model enables the company to stand strong. In fact, 89% of Sidetrade’s revenues are recurrent. Furthermore, Sidetrade’s key account attrition rate is one of the lowest in the cloud industry, a mere 4.2% in June 2020, vs. 5% in June 2019.

103% growth in net profit while pursuing an offensive investment strategy

In the first half of 2020, Sidetrade’s operating profit leapt 94% to €1.3M, reflecting increased revenues in the period, and the leverage of the firm’s pure SaaS model. This outstanding performance results from a €1.6M increase in gross margin to €11.4M (vs. €9.8M in H1 2019), i.e. 79% of revenue. SaaS subscriptions contribute 93% of this margin, demonstrating the incremental profitability of this model.

H1 also saw an additional €1.6M investment in additional sales and marketing resources (up 16%) to build future growth.

The unprecedented circumstances of the pandemic generated €0.7M in savings in the period, due mainly to decreases in travel expenses and sales bonuses.

Operating profit included a €0.9M research tax credit (vs. €1.0M in H1 2019), as well as €0.10M in activation of R&D costs (vs. €0.15 in H1 2019).

Driven by these dynamics, H1 net earnings reached €1.1M, up 103%.

Strengthened financial position

As of 30 June 2020, Sidetrade’s financial structure remained especially strong. Cash stood at €11.8M vs. €5.3M on 31 December 2019). Debt is virtually nil (€0.3M).

The company holds 66,000 of its own shares, at an estimated value of €4.6M as of 30 June 2020.

Given Sidetrade’s excellent H1 performance despite the crisis, management has every confidence that FY2020 will be a year of double-digit growth.