Commenting on the results, Olivier Novasque, CEO and Founder of Sidetrade, stated:

Revenue for the first nine months of 2025 was fully in line with our expectations, despite a volatile and challenging economic environment that weighed on new project signings during the first half. The rebound in bookings in the third quarter, particularly in the US, points to a gradual return to normal activity over the coming quarters. It is precisely in such demanding times that our teams have always shown their ability to turn constraints into opportunities. Beyond the promising rollout of our two new growth driver for the years ahead, agentic AI and the development of a partner network, Sidetrade has taken a major step toward its global ambitions with the October 13 announcement of the planned acquisition of ezyCollect, a leading Order-to-Cash player in the Asia-Pacific region. This transaction will extend our presence to three continents, open access to a global mid-market of several million companies, and accelerate the large-scale deployment of our AI agents, whose impact on small and midsize businesses will be transformative. Finally, the recent Gold and Silver distinctions from EthiFinance and EcoVadis highlight that AI and sustainability are not opposing forces; they complement each other in value creation. As we enter the final quarter of the year, we confirm our profitable growth objectives for 2025 and look ahead to 2026 with confidence, backed by a stronger-than-ever model and clearly identified growth levers for the years to come.

Q3 2025 Rebound in Bookings (27%) Narrows the Gap at the End of September Compared to the First Nine Months of 2024

For the first nine months of 2025, Sidetrade’s new Annual Contract Value (ACV) reached €7.81 million, compared to €8.94 million in the same period of 2024. As announced during the investor presentation on September 18, 2025, the expected rebound in Q3 2025 bookings (up 27%), traditionally the slowest quarter, helped narrow the year-to-date gap compared to 2024 to down 13%, from down 21% at the end of June 2025. Note that 2024 marked a record year for bookings.

After a cautious first half of 2025 marked by macroeconomic uncertainty, new projects are gradually picking up momentum, especially in the US. In Q3 2025, new Annual Recurring Revenue (ARR) rose 20%, while services bookings increased 30%. The rollout of our two growth engines, Sidetrade’s agentic AI and the development of a global partner network, will have a significant impact on next year’s bookings in 2026 and underpin the Group’s long-term confidence.

Strong Revenue Growth of 12%, Including 17% in SaaS Subscriptions

| Sidetrade (€m) |

First nine months of 2025 | First nine months of 2024 | Change |

| SaaS subscriptions | 38.7 | 33.0 | +17% |

| revenue | 44.4 | 39.7 | +12% |

2025 figures are from unaudited consolidated data.

Sidetrade continues to deliver sustained revenue growth. For the first nine months of 2025, the Group reported consolidated revenue of €44.4 million, up 13% at constant currency and 12% on a reported basis.

SaaS subscription revenue reached €38.7 million, an increase of 19% at constant currency (17% reported). On a comparable scope basis (excluding SHS Viveon), organic growth reached 12%, confirming the resilience of Sidetrade’s recurring revenue base in a challenging economic environment.

The Group’s strategic focus on enterprise accounts continues to drive growth. Subscriptions from companies with annual revenue above €2.5 billion rose 30% and now account for more than half of the customer base (54%). This strong performance underscores Sidetrade’s strong traction among multinational clients.

International operations remain a key growth driver for the Group, with 69% of revenue in the first nine months of 2025 generated outside France, reflecting continued expansion and strengthened global footprint.

Gold Medal from EthiFinance for Sidetrade, now ranking among the top 15% of high-performing companies evaluated by EcoVadis

Sidetrade has further strengthened its Environmental, Social, and Governance (ESG) credentials by ranking among the top 15% of companies assessed by EcoVadis, the global benchmark in sustainability ratings. The Group once again earned the Silver Medal, with a score of 70/100, recognizing the maturity of its ESG program.

Sidetrade also received the Gold Medal from EthiFinance, an independent ESG rating agency recognized for its alignment with the EU sustainability standards (Taxonomy and CSRD), achieving an ESG score of 77/100. This distinction places Sidetrade among Europe’s leading tech companies in governance, social impact, and environmental performance. The Group stood out for its advanced initiatives in human rights, diversity, responsible procurement, and carbon management, as well as the transparency of its non-financial reporting.

With this dual recognition, Sidetrade reaffirms its status as a sustainability leader in enterprise technology.

Already number one in Europe and among the top 3 leaders in North America, Sidetrade is now preparing to expand its footprint to the Asia-Pacific region with ezyCollect, the market leader in Order-to-Cash (O2C) solutions in its domestic market. Together, the two SaaS providers will enable thousands of SMBs across both hemispheres to leverage the power of agentic AI, drawing on a Data Lake whose richness in corporate payment behavior will be unique in the world.

During our visit to Sydney, I was impressed by the expertise and talent of the ezyCollect teams, their forward-thinking vision of the mid-market, and their amazing speed of execution, said Olivier Novasque, Sidetrade’s founder and CEO. With ezyCollect, Sidetrade has now all the assets required to achieve its global ambitions. This proposed acquisition opens immediate access to Asia-Pacific, one of the world’s most dynamic economic regions, while enhancing our ability to support the subsidiaries of our multinational clients operating in the area. Beyond geographic expansion, ezyCollect’s SMB total addressable market is huge and represents a tremendous opportunity for Sidetrade’s agentic AI. AI agents will have a massive impact on this segment, where cash is critical, and companies often lack the scale to build specialized Order-to-Cash teams. By combining ezyCollect’s simplicity of deployment and usage with the power of our agentic AI, we aim — together with the ezyCollect teams — to roll out these mid-market solutions across all the regions where we are already operating, marking a major step forward in Sidetrade’s global development.

ezyCollect, the Australian SaaS leader in Order-to-Cash for SMBs

Founded in 2014 in Sydney (Australia), ezyCollect is a leading SaaS player in O2C solutions dedicated to the mid-market. With 53 employees, more than 1,100 client companies representing A$19 billion in B2B receivables managed in its Cloud and about 320,000 debtors, ezyCollect has become the best in class in Australia and New Zealand and recently began its expansion into the United States.

Within just 90 days, ezyCollect clients typically see a 40% reduction in late payments and an 80% decrease in bad debt. The company stands out through:

- Comprehensive O2C cycle coverage (credit risk management, collections and payment portal);

- Advanced electronic payment technology, a strong growth driver amid the accelerating digitalization of B2B transactions;

- Outstanding customer retention for this market segment, with 89% of gross retention, reflecting a solid delivered value;

- Very high business growth, with a 28% CAGR over the past three years.

For the 2025 calendar year, ezyCollect expects revenue of approximately A$14 million (around €8 million), up 28% from 2024. Despite funding its strong growth, the company is nearing operating breakeven (EBITDA break-even) as early as 2025, confirming the strength of its recurring model and cost discipline.

In 2026, ezyCollect’s revenue is projected at A$18 million (just over €10 million), representing expected growth of 29%. Synergies from rolling out ezyCollect’s offerings in all Sidetrade regions (notably Europe and the U.S.), combined with the integration of Sidetrade’s agentic AI technology into ezyCollect solutions, should significantly accelerate ezyCollect’s revenue trajectory in the coming years.

To preserve the entrepreneurial culture and mid-market DNA that have driven ezyCollect’s success so far, its management team will remain primarily responsible, independently from Sidetrade’s enterprise sales force, for leading the go-to-market of the new AI offering, “ezyCollect by Sidetrade,” targeting SMBs in all markets where the Group operates.

ezyCollect’s integration into Sidetrade would be effective retroactively as of October 1, 2025. Starting next year, the new Asia-Pacific (APAC) region is expected to represent nearly 13% of the Group’s consolidated revenue, further strengthening its international profile. France would then account for only about 25% of consolidated 2026 revenue — a new global balance, a rare achievement for a company of this scale, that will diversify income streams, enhance the Group’s resilience to regional economic cycles, and reinforce the visibility of its mid-term growth profile.

Asia-Pacific expansion, extending into SMBs and B2B payments

The global O2C solutions market is estimated at US$8.8 billion by 2030, with an average annual growth rate of 12.9% (source: Accounts Receivable Automation Market Size Report, 2024-2030, Grand View Research).

With this acquisition, Sidetrade will now have a global presence across three continents:

- Europe, its historical core market;

- North America, strengthened by the 2024 acquisition of CreditPoint Software;

- Asia-Pacific, with ezyCollect becoming Sidetrade’s regional headquarters in Sydney.

This new base will enable Sidetrade to operate seamlessly across all time zones and fully extend its follow-the-sun model on a global scale.

ezyCollect: new global distribution channel for Sidetrade’s agentic AI

Finance functions are undergoing a revolution. After a decade of algorithmic automation, they are entering the era of AI agents, capable of understanding, learning, and deciding. Sidetrade’s agentic AI, Aimie, pioneered autonomous finance for enterprises: systems that act and self-optimize continuously, without human intervention in certain processes.

With this project, ezyCollect would become the first player to bring agentic AI to the mid-market, a segment often constrained by limited resources. ezyCollect adds a client base of over 1,100 companies, growing at nearly 30% annually.

By integrating Aimie, ezyCollect customers will gain enterprise-level capabilities without increasing headcount or organizational complexity. Aimie works continuously, like a team member in remote, sending reminders, tracking payments, detecting delays, and adapting to each situation without human input. Where time and staff shortages limit efficiency, agentic AI delivers constant presence, precise execution, and real-time visibility into cash flows.

Joining Sidetrade is a major step forward for ezyCollect and a giant leap for all mid-market companies we already help succeed said Arjun Singh, CEO and co-founder of ezyCollect. We are proud to join forces with the world’s leader in Order-to-Cash, whose advance in agentic AI is unmatched worldwide. With the power of Aimie agents, our clients will benefit from efficiency and intelligence standards previously reserved for large enterprises. This partnership gives us global scale, accelerates our innovation, and preserves our agile DNA and customer proximity.

AI learning on a global scale, from SMBs to multinationals

Sidetrade would offer two complementary O2C solutions: Augmented Cash, recognized by Gartner® as a Leader in the Magic Quadrant™ and designed for large enterprises; and ezyCollect by Sidetrade, tailored for the mid-market. Together, they will cover the full O2C spectrum from small businesses to multinationals and combine innovation, geographic coverage, and operational excellence to generate both technological and commercial synergies.

We are delighted to welcome ezyCollect’s team at Sidetrade, added Olivier Novasque. This partnership goes beyond geography; it unites two teams that share the same values and the same ambition: to invent the Order-to-Cash of tomorrow. By aggregating proprietary payment-behavior data from the Americas, Europe, and APAC, we will further elevate the intelligence of our Aimie agents to deliver tangible performance, from mid-market firms to global enterprises, around the clock and across time zones.

Sidetrade’s Data Lake, already the largest repository of B2B corporate payment behavior worldwide, analyzing US$7.2 trillion in transactions, will be significantly enriched by APAC mid-market data. This new input will provide Aimie with deeper regional insight into intercompany credit dynamics and enhance the autonomy of its agentic algorithms. In practice, weak signals captured in Sydney or Wellington will inform Aimie’s decisions in Paris, London or Houston – a distributed machine learning loop where each transaction feeds collective intelligence and refines global accuracy, speed, and adaptability.

At the heart of the B2B payments revolution

From Sidetrade’s perspective, a key technological advancement lies in integrating ezyCollect’s payment digitalization module into its platform. This integration will extend the functional scope of Augmented Cash by adding native payment management capabilities, delivering a fully digitalized end-to-end solution, from order to payment, including e-invoicing and collections.

This upcoming feature will position Sidetrade at the forefront of the fast-growing electronic payments wave, a rapidly growing segment that is reshaping the digital customer experience. The goal is to deliver frictionless cash-flow management and pave the way for global monetization of B2B transactions.

A major acquisition for Sidetrade

The contemplated transaction covers 100% of ezyCollect’s share capital, Sidetrade’s tenth since the Group’s creation, and will also be its largest acquisition in both scale and value. It is marking a strategic turning point in its international expansion.

The deal represents an estimated value of around €37 million, including an initial payment upon closing and a potential earn-out based on revenue growth through 2028.

Based on ezyCollect’s forecast for 2026, the EV valuation of ezyCollect represents approximately 3.7 times its projected next-twelve-month revenue (NTM), a reasonable multiple for a fast-growing SaaS player nearing operational profitability, and uncommon within the regional market.

The cash component of the contemplated transaction will be financed through a combination of the Group’s available cash resources and a long-term bank loan facility of €25 million, bearing a fixed rate of approximately 3.1% secured through hedging instruments.

As a reminder, Sidetrade treasury totaled €48.7 million as of June 30, 2025, including €21.5 million in treasury shares, prior to this transaction.

This financing structure allows Sidetrade to maintain a solid cash position and capacity for future inorganic growth opportunities, while preserving financial discipline.

The acquisition of ezyCollect is expected to close in the next few weeks, subject to customary closing conditions.

Sidetrade was advised by King & Spalding LLP (Laurent Bensaid, Julien Vicariot, and Carla De Checchi) as legal counsel. ezyCollect was advised by U.S. investment bank AGC Partners and law firm Thomson Geer.

| Sidetrade (€m) |

H1 2025 | H1 2024 | Change (%) |

|---|---|---|---|

| Revenue | 29.3 | 24.8 | + 18% |

|

of which SaaS subscriptions |

25.4 | 20.5 | + 24% |

| Gross margin | 22.6 | 19.9 | + 14% |

| as a % of Half-year Revenue | 77% | 80% | |

| EBITDA* | 5.6 | 4.2 | + 33% |

| as a % of Half-year Revenue | 19% | 17% | |

| Operating margin** | 4.6 | 3.6 | + 29% |

| as a % of Half-Year Revenue | 16% | 15% | |

| Net profit | 4.1 | 3.6 | + 15% |

* EBITDA corresponds to operating margin before depreciation and amortization of tangible and intangible fixed assets and impairment losses.

** Operating margin corresponds to operating profit based on 2024 accounting standards in France, including the French Research Tax Credit.

In an adverse macroeconomic environment, both in Europe and in the US, Sidetrade succeeded this semester in sustaining a growth trajectory while delivering very high profitability, once again underscoring the strength of our model. The Group maintained a booking level comparable to the first half of 2023, just before the record performance set in H1 2024, by leveraging its installed customer base and product innovation. While bookings and revenue from related services were temporarily impacted by market conditions, SaaS subscription revenue was up 24% overall, including 12% organic growth. This momentum validates our international expansion strategy undertaken in 2022, with nearly two-thirds of revenue now generated internationally. Aside from our focus on international markets, which is rather unique for a company of our size, the growing share of multinational clients, accounting for more than two-thirds of our SaaS subscriptions, serves to strengthen the visibility and resilience of our business model, said Olivier Novasque, CEO and Founder of Sidetrade. 2025 also marks the launch of two new growth drivers that will accelerate bookings starting in 2026. The first is Aimie, a new autonomous and interactive AI Cash Collection Agent, hailed by analysts as a game changer in Order-to-Cash and sparking strong enthusiasm among clients. The second is the development of a global partner network, fronted by a dedicated team already initiated through a first worldwide distribution agreement with a leading player in Order-to-Cash services. This lever has significant potential for bookings growth, considering that indirect sales account for more than half of our main competitor’s bookings, while still in their infancy at Sidetrade. Lastly, the demanding economic environment prompted us to reinforce operational discipline, combining strict cost management with optimized resource allocation. Results are already surpassing our expectations. For the first time in our history, EBITDA topped the symbolic €5 million mark (€5.6 million), up a significant 33%, while operating margin surged 29%, reaching 16% of H1 revenue, 17% on a like-for-like basis. With nearly 90% recurring revenue, profitability among the highest in its category, and a strong financial position, Sidetrade has all the resources to seize targeted opportunities for external growth.

Bookings resilience and new growth drivers for 2026

In the first half of 2025, Sidetrade recorded €5.88 million in ACV bookings, including €2.44 million in new SaaS subscriptions and €3.44 million in services.

The average initial period of new contracts remained high at 44.5 months, well above SaaS industry standards, ensuring visibility and resilience. In a depressed economic environment across Europe and the US, this performance was down 21% from the record €7.42 million in H1 2024 but stable compared to €5.83 million in H1 2023.

Commercial momentum, propelled by the installed customer base, helped offset reduced enterprise investment in new projects. For the first time, Cross-Selling (45%) and UpSelling (25%) represented a combined 70% of bookings, compared to 30% for New Business. This trend reflects customer satisfaction, with clients both deepening adoption of existing solutions and implementing new features regularly released by Sidetrade.

- New growth catalysts: agentic AI and global partnerships

During the period, Sidetrade activated two new growth drivers expected to contribute from 2026: the industrialization of Aimie, the first autonomous AI Cash Collection Agent (see press release), which is already igniting strong interest from large enterprises (see press release), and the expansion of its distribution channels through global alliances, paving the way for business with the Global 2000 Companies.

Strong revenue growth, up 18%, with 24% SaaS subscription

In H1 2025, Sidetrade reported consolidated revenue of €29.3 million, up 19% at constant exchange rates (+18% reported basis). SaaS subscriptions, the main growth driver, totaled €25.4 million, up 25% at constant exchange rates (+24% reported basis). On a like-for-like basis (excluding SHS Viveon), SaaS growth was 12%, confirming the strength of Sidetrade’s recurring revenue model.

Momentum with large key accounts continues. Subscriptions from companies with more than €2.5 billion in annual revenue grew +42% and now represent more than half of the portfolio, cementing Sidetrade’s positioning with multinationals.

International markets remain a pillar of Sidetrade’s growth strategy. In H1, 69% of revenue was generated outside France, confirming the Group’s global expansion and elevating its international status.

Profitability exceeding expectations

- Robust gross margin at 77% of revenue (80% like-for-like), up 14%

Gross margin stood at €22.6 million, up €2.7 million compared with the first half of 2024, against a continued challenging macroeconomic background. The gross margin rate came out to 77% of H1 revenue (vs. 80% a year earlier). On a like-for-like basis (excluding SHS Viveon), it reached 80% and remained stable at 92% for SaaS subscriptions, confirming the structural resilience of the model.

- EBITDA up 33% to €5.6 million, reaching 19% of H1 revenue (20% on a like-for-like basis)

In addition to the financial indicators traditionally published, Sidetrade now includes EBITDA, a benchmark indicator for assessing operating performance before depreciation and amortization.

In the first half of 2025, EBITDA amounted to €5.6 million, exceeding the symbolic €5 million milestone for the first time, with a surge of +33%, bringing the margin to 19% of H1 revenue. On a like-for-like basis (excluding SHS Viveon), the margin reached 20% of H1 revenue, an improvement of 3 points versus the first half of 2024.

- Record operating margin of 16% of H1 revenue (17% on a like-for-like basis), representing strong growth of +29%

The operating margin in the first half of 2025 reached €4.6 million, up 29% compared to €3.6 million in H1 2024, representing 16% of H1 revenue (vs. 15% a year earlier). On a like-for-like basis (excluding SHS Viveon), the margin climbed to 17% of H1 revenue, up 2 points compared to the first half of 2024.

This record level of profitability attests to the full impact of operational leverage. In a tense market environment, characterized by companies adopting a wait-and-see approach to investment, Sidetrade successfully capitalized on the momentum of its recurring revenue while strengthening its budgetary discipline. Cost control, particularly in the sales and marketing functions, was accompanied by an improvement in operational efficiency.

This remarkable improvement in profitability indicators in the first half of 2025 enabled Sidetrade to maintain an ambitious investment policy, with €1.3 million in additional R&D spending, primarily devoted to the development of agentic AI.

The operating margin for the first half of 2025 also includes a €1.7 million Research Tax Credit (vs. €1.4 million in H1 2024) and a marginal activation of R&D expenses (€0.15 million, or 2% of R&D costs for the half-year).

Overall, the increase in the operating margin to 16% (17% on a like-for-like basis), compared with 15% in the first half of 2024, reflects continued operational efficiency gains and the achievement of a new profitability milestone.

Half-year net profit up 15% to €4.1 million

The financial result, which stood at €0.1 million for the first half of 2025 (vs. €0.3 million in H1 2024), mainly reflects interest income from short-term cash investments.

Corporate income tax expense is estimated at €0.6 million for the first half of the year, up slightly from €0.4 million in the same period last year.

All told, the 15% increase in Sidetrade’s net income in the first half of 2025, to €4.1 million, marks a new level of profitability and confirms the Group’s ability to reconcile revenue growth with improved profitability, despite a continued challenging economic environment.

Strengthened financial position

As of June 30, 2025, Sidetrade reported €27.2 million in gross cash, up €2.0 million compared to December 31, 2024, excluding the calendar effect related to the reimbursement of the Research Tax Credit. The Group also held 85,600 of its own shares for a value of €21.5 million at the end of June 2025.

Meanwhile, net financial debt remains very low, with gross debt reduced to €6.8 million (-€1.1 million in six months).

With a strong net cash position and controlled debt, Sidetrade has the flexibility to finance its investments and support its expansion, while maintaining a robust balance sheet profile.

Structured in accordance with the voluntary CSRD VSME framework, Sidetrade’s 2024 report tells a standout story in the tech industry: a company that, in 2024, achieved remarkable revenue growth (+26%) while reducing its carbon footprint by 3.3%. This contrast reflects Sidetrade’s core ambition: to decouple business growth from environmental impact.

Cash is still the oxygen that fuels business growth. But that growth must no longer come at any cost. We have set a new standard, one that aligns performance with purpose, said Olivier Novasque, CEO and founder at Sidetrade. Our agentic AI, Aimie, must be useful, efficient, and capable of delivering business value, operational excellence, and positive societal impact.

In 2024, Sidetrade launched an ambitious digital sobriety program. With a virtualization rate of 95.6%, data centers powered by renewable energy (both in Europe and North America), and a Power Usage Effectiveness of 1.39 (well below the EU average*), Sidetrade is redefining SaaS industry benchmarks.

Sidetrade also made a notable impact in non-financial ratings, earning a Platinum Medal from EthiFinance and a Silver Medal from EcoVadis, placing it among the top 15% of rated companies in Europe. This recognition highlights both its tangible carbon reductions and the strength of its CSR governance, led by a dedicated committee reporting to executive leadership.

Excellence and ambition are the dual engines of our CSR journey, said Philippe Gangneux, CFO and CSR Ambassador at Sidetrade. Excellence ensures discipline in our commitments; ambition pushes us to aim higher, to reach further, and to generate lasting impact.

As an active member of the United Nations Global Compact, Sidetrade has aligned its roadmap with 10 of the UN’s Sustainable Development Goals, including climate action, workplace equity, ethical governance, and digital resilience.

The 2024 Sidetrade CSR report, with detailed performance indicators, is available here.

The decision reflects a growing trend among forward-looking finance organizations. In an environment marked by global volatility and operational complexity, legacy systems — dominated by rigid ERP structures and static workflows — have become increasingly inadequate. Rules-based automation and digital assistants, while useful, have reached their ceiling. Agentic AI is the new operating standard for competitive finance.

To stay ahead, CFOs are turning to Aimie to operationalize a new system of work: intelligent, autonomous, always on. This shift positions SECURITAS among the first companies to integrate agentic AI as an operational co-worker. Aimie redefines what AI can do by transforming Order-to-Cash from a scripted back-office function into a self-optimizing system of intelligence. She is a teammate who manages cash collection.

Purpose-built for corporate finance and backed by Sidetrade’s $7.2 trillion transaction Data Lake, Aimie brings contextual intelligence to every interaction. Her capabilities include:

- Autonomous, context-driven calls intelligently orchestrated across thousands of customer accounts

- Continuous learning from customer payment behaviors and live interactions to deliver tailored dialogue, in real-time

- Integrating natively with the Sidetrade platform to drive dynamic Order-to-Cash adjustments and real-time case management, without human intervention

Aimie delivers consistent, policy-aligned execution at scale, driving measurable gains in cash flow, reducing manual workload, and enabling finance teams to refocus on higher-value priorities.

By embracing agentic AI, SECURITAS joins a growing group of enterprises that gain a structural advantage in financial execution. Those who hesitate risk being overtaken by faster, leaner, more adaptive competitors.

Olivier Novasque, CEO of Sidetrade commented:

Given the current macroeconomic environment, we were unable to replicate our record-breaking booking from the first half of 2024, which had seen a 25% year-over-year increase. As anticipated, H1 2025 reflects a 21% decline from that record high, impacted by companies’ cautious stance toward launching new investment projects. Nonetheless, our well-balanced footprint across Europe and North America, where early signs of recovery are emerging, combined with a diversified mix of new deals and upsells to our existing client base, helped maintain bookings at levels comparable to H1 2023, before the 2024 peak.

While full-year 2025 booking is expected to follow a similar trend, early market feedback on the launch of our autonomous AI Cash Collection Agent is highly encouraging and supports the prospect of a significant reacceleration starting in 2026. Furthermore, the global alliance signed in June with a leading Order-to-Cash services firm is a new growth catalyst, expected to deliver material impact from 2026 onward. Additional agreements of this nature are in advanced stages and will enhance commercial momentum over the coming years.

On the revenue front, we posted strong growth of +19% at constant exchange rates, including +25% for our SaaS subscriptions. This performance was driven by 1/ the consolidation of SHS Viveon in H1, 2/ strong growth in our subscriptions in the US (+26%), and 3/ a sharp increase in subscriptions from enterprise clients generating over $2.5 billion in revenue (+42%). With nearly 90% recurring revenue and two new growth engines set to kick in from 2026, Sidetrade is well-positioned to sustain a robust and highly predictable business model. We are now entering a new phase in our growth journey, one that will once again redefine the scale and scope of our company over the next three years.

Resilient booking performance against a record 2024 and challenging macro backdrop

In H1 2025, Sidetrade recorded €5.88 million in new Annual Contract Value (ACV), down 21% from the €7.42 million reported in H1 2024, which marked an all-time high (+25% vs. H1 2023). While the economic context and an exceptionally high comparison base weighed on performance, H1 2025 ACV remained in line with the pre-peak level of H1 2023 (€5.84 million), demonstrating the strength of Sidetrade’s commercial model.

New Annual Recurring Revenue (New ARR) came in at €2.44 million, down 38% from the record €3.95 million in H1 2024. Q1 2025 was exceptionally soft in North America, which accounted for only 8% of New ARR. However, a strong Q2 2025 rebound lifted the US contribution to 34% of total new contract value for the first half of the year.

Service booking, which are generally billed within twelve months of being signed, remained stable at €3.44 million in H1 2025 (vs. €3.47 million in H1 2024), with reduced large-scale investment activity, particularly in the US, offset by strong expansion projects within the existing client base, including €1.44 million from SHS Viveon customers in Germany.

The average initial contract period for new clients (excluding renewals) remained high at 44.5 months (vs. 44.8 in H1 2024), significantly above the SaaS industry average (24–36 months), reflecting strong client confidence and contributing to revenue visibility and resilience.

In a notable shift in trend, only 30% of H1 2025 bookings came from New Business, compared to the historical range of 50–60%. This was due to greater caution among enterprises, especially in North America. Conversely, Cross-sell deals (new entities within a group and/or additional modules, such as CashApp, Credit Risk Expert, or e-Invoicing) accounted for 45% of total bookings (up from 20% previously), while upsells to existing clients contributed 25%. Together, Cross-Sell and UpSell accounted for 70% of signatures, clear evidence of strong customer satisfaction and revenue retention. This also reflects Sidetrade’s ability to capture incremental growth from existing enterprise clients through a multi-product platform strategy, even in a challenging environment.

AI Agent and strategic alliances open up new structural growth opportunities for order intake

H1 2025 marked a strategic inflection point, with two new growth levers expected to reshape Sidetrade’s medium-term commercial trajectory: the industrialization of agent-based AI and the expansion of distribution channels through global partnerships.

In May 2025, Sidetrade unveiled the first autonomous AI agent for cash collection. Designed to operate without human supervision, this next-generation intelligent agent, embodied by Aimie, is a game-changer in the Order-to-Cash space. With strong interest from enterprise clients seeking immediate cash generation improvements, large-scale commercialization is scheduled for early 2026, with some early-stage pre-orders possible in Q4 2025. Initial feedback indicates that AI agents could significantly boost commercial momentum starting next year.

In parallel, Sidetrade signed a global partnership in June with a major international consulting firm specializing in finance transformation. The agreement provides privileged access to Global 2000 strategic accounts across services, manufacturing, and healthcare, and is expected to generate incremental pipeline growth across North America, EMEA, and APAC.

Backed by a substantial installed base, breakthrough innovation, and expanded go-to-market capabilities, Sidetrade is well-equipped to accelerate its commercial growth in the coming years.

Strong revenue growth: +18%, including +24% SaaS subscription growth

| Sidetrade (€m) |

H1 2025 | H1 2024 | Change |

| SaaS Subscription Revenue | 25.4 | 20.5 | +24% |

| Total Revenue | 29.3 | 24.8 | +18% |

All the 2025 information of this financial release is from consolidated, unaudited data.

Sidetrade posted consolidated revenue of €29.3 million in H1 2025, up 19% at constant exchange rates and 18% on a reported basis.

SaaS subscription revenue rose to €25.4 million, representing a 25% increase at constant exchange rates (+24% reported). On a like-for-like basis (excluding SHS Viveon), growth stood at +12% constant. This solid performance confirms the strength of Sidetrade’s SaaS business model, with recurring revenue driving robust results amid economic uncertainty.

Growth was robust among enterprise accounts. SaaS subscriptions from companies generating over €2.5 billion in annual revenue surged 42%, now representing 54% of total subscription revenue, underscoring Sidetrade’s growing penetration of large international enterprises. This high-end market segment is expected to remain a significant growth driver in the coming quarters.

Service revenue totaled €3.9 million, down 8% compared to H1 2024 and 32% on a like-for-like basis. This was due to fewer large-scale projects and more limited service engagements tied to upsell deals.

The consolidation of SHS Viveon (effective July 1, 2024) contributed €3.9 million, or 13% of total H1 2025 revenue.

It is worth noting that all Sidetrade multi-year contracts are indexed to inflation (Syntec index for Southern Europe, UK CPI for Northern Europe, and US CPI for the United States), ensuring that annual pricing updates are automatically reflected in subscription revenue, without waiting for contract renewals.

On July 7, 2025, in a moment filled with pride and emotion, Sidetrade’s Founder and CEO, Olivier Novasque, visited the Euronext Paris headquarters alongside some of the company’s historic figures to mark two decades of public listing. The traditional market opening bell ceremony highlighted two decades of uninterrupted

growth and bold entrepreneurship that have established Sidetrade as a world leader in the Order-to-Cash space. Twenty years after its IPO, Sidetrade stands as a unique French tech success story, built on a foundation of performance, innovation, resilience, and independence.

Olivier Novasque (Founder & CEO, Sidetrade)

surrounded by core team members and historic contributors.

A founding vision: leveraging technology to power business cash flow

When Olivier Novasque founded Sidetrade in 2000, his goal was to build a valuable, agile company ahead of its time. He foresaw the need to reinvent the financial relationship between customers and suppliers, moving away from a purely administrative model toward one driven by performance. Based on this vision, he laid the foundation for a technology platform designed to deeply transform cash flow generation. Going against the prevailing standards of the time, he rejected the dominant on-premises model and bet on SaaS from the very beginning, an audacious move that proved visionary.

A former finance executive turned entrepreneur, Novasque made the rare choice to raise only essential funds. Instead, he prioritized self-financed growth, aiming to build a high-quality, industrial-grade, tech-driven business.

I believe the best companies aren’t necessarily those that raise the most money, but those that work tirelessly to execute their vision with rigor, creativity, and resilience, said Olivier Novasque, CEO and founder at Sidetrade. Today, I want to honor everyone, past and present, who has contributed to Sidetrade’s journey. I’m proud to be surrounded by an executive team united by a spirit of ambition, innovation, and excellence. Together, with all Sidetraders, we are ushering Order-to-Cash into the age of the Agentic Revolution.

For years, tech company success was often measured by the size of their fundraising rounds rather than their ability to sustain a viable business model. Sidetrade took a different route, rooting its growth in self-financing. Aside from €2 million raised pre-IPO and a €4.5 million capital increase at IPO, Sidetrade has never resorted to public fundraising or shareholder dilution.

As of today, the company holds nearly €50 million in cash and treasury shares. This performance is the result of a sustained growth strategy and over a decade of investment in artificial intelligence, funded entirely by the company’s ability to generate cash year after year. In 2024, the company delivered a standout performance:

- Revenue growth of +26% (+16% on a comparable basis)

- Operating margin of 15%

- Net income of €7.9million

- Free cash flow of €8.7million

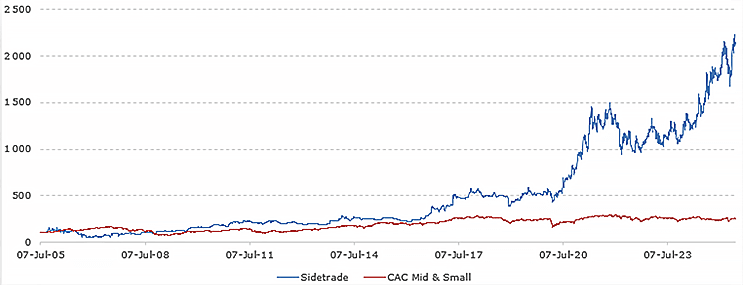

This financial discipline has in no way compromised shareholder value creation. Listed at €12.50 in 2005, Sidetrade’s share price has increased twentyfold, reaching €249 as of July 4, 2025. This represents a stock market performance of over +1,800%, more than 11 times that of the CAC Mid & Small index, which rose by +164% over the same period.

Sidetrade’s share price growth, indexed to 100 since IPO (July 7, 2005)

A recognized technology leader

Innovation is part of Sidetrade’s DNA. In 2025, the company’s innovation capabilities were recognized by some of the most respected rankings in the sector:

- Named a Leader in Gartner® Magic Quadrant™ for the third consecutive year

- Identified by IDC as a key player in financial automation

- Ranked among Europe’s 150 Most Innovative Companies by Fortune

These accolades highlight the uniqueness of Sidetrade’s technology foundation, which includes a cloud-native architecture, proprietary action-oriented AI, and a one-of-a-kind payment behavior Data Lake, enriched with over $7.2 trillion in intercompany transactions.

From its humble beginnings in a Paris office to a global presence, Sidetrade has followed a trajectory of organic growth reinforced by nine acquisitions. The company has rigorously executed its model while expanding geographically across Germany, the UK, Ireland, the US, Canada, and of course, France. Today, with 65% of revenue generated outside France, Sidetrade supports major enterprises in 85 countries as a partner in their financial transformation.

Sidetrade’s inclusion in the Euronext Tech Leaders index in June 2025 marks more than institutional recognition; it affirms the rise of a European tech champion capable of combining breakthrough innovation with profitable growth to power the next generation of enterprise finance.

Congratulations to Sidetrade on 20 years of public listing on Euronext, said Delphine d’Amarzit, Euronext Paris Chairwoman and CEO. Sidetrade’s remarkable stock market journey is a testament to its sustained growth and demonstrates the power of Euronext to help local SMEs become global mid-cap players while preserving their independence. It perfectly embodies the synergy between entrepreneurial ambition and the excellence of European capital markets, recently underscored by Sidetrade’s entry into the Euronext Tech Leaders index.

Sidetrade’s unique trajectory, combining technological innovation, financial performance, and capital discipline, is now catching the attention of American institutional investors. Sidetrade’s stock performance reflects a remarkable growth journey and a robust business model built on high revenue recurrence, operational excellence, and cash generation, said Jean-Pierre Tabart, Senior Analyst at TP ICAP Midcap. Above all, we believe the group still holds significant upside potential. Beyond the strength and durability of its fundamentals, a substantial valuation gap remains compared to North American SaaS players. Moreover, the current share price does not reflect the stock’s strategic value, driven by its scarcity—there are very few opportunities in the European market to gain exposure to a true SaaS company—and by Sidetrade’s lead in artificial intelligence, which is expected to further reinforce its technological leadership in the Order-to-Cash space.

Sidetrade is one of the few long-term success stories on the Euronext stock market. With a robust and exportable model, the company has established itself as a global leader with solutions deployed across multinational companies. This trajectory, built with discipline and vision, is now entering a new chapter: one of AI-augmented finance, where more intelligent, more autonomous, and entirely focused on the AI agent revolution.

The Europe’s Most Innovative Companies 2025 list, compiled by Fortune in partnership with Statista, is based on more than 108,000 evaluations by experts and employees, enriched by the LexisNexis® patent portfolio index. Each company is assessed across three dimensions: product innovation, process innovation, and innovation culture. Sidetrade stood out for the strength of its innovative mindset, a key driver in its ability to reshape financial practices across the Order-to-Cash field.

This recognition crowns a continuous innovation trajectory that began with the company’s founding in 2000. This momentum originated in Paris, France, where the company built its technological foundation within an ecosystem that has since achieved global recognition. As of 2025, the French capital’s technology ecosystem ranks fourth globally, according to Dealroom, surpassing London, Munich, and Stockholm.

Since its inception 25 years ago, Sidetrade has been at the forefront of technological disruption, said Olivier Novasque, Founder and CEO of Sidetrade. This recognition by Fortune comes at a pivotal moment, as we enter the era of agentic AI. For our clients, this marks the era of augmented finance, with virtually unlimited capabilities that can absorb business complexity. For us, it reflects a technological lead we estimate to be over three years ahead of our market.

By equipping finance departments with autonomous agents capable of acting, communicating, and adapting in real time, Sidetrade is redefining the foundations of the Order-to-Cash process. This shift from assistive AI to executional AI represents a strategic inflection point, described by several analysts as a business model transformation.

The emergence of agentic AI marks a turning point in the operating model of corporate finance, noted Jean-Pierre Tabart, Analyst at TP ICAP. With its technological lead, mastery of real-time behavioral data, and ability to industrialize autonomous intelligence at scale for large enterprises, Sidetrade stands out as a strategically undervalued asset, poised to capture increasing value in an under-equipped market.