The Global Payment Gap in B2B

In a volatile macroeconomic environment, B2B payment behavior reveals buyers’ efforts to optimize their working capital, along with the resulting commercial tensions and cash-flow risks that follow.

The Sidetrade Data Lake shows 37% of the days-to-pay cycle now happens after the payment due date. This shift increases uncertainty in suppliers’ cash-flow forecasting and raises the stakes in working capital management.

Regional Discipline, Not Terms, Explains Who Gets Paid Faster

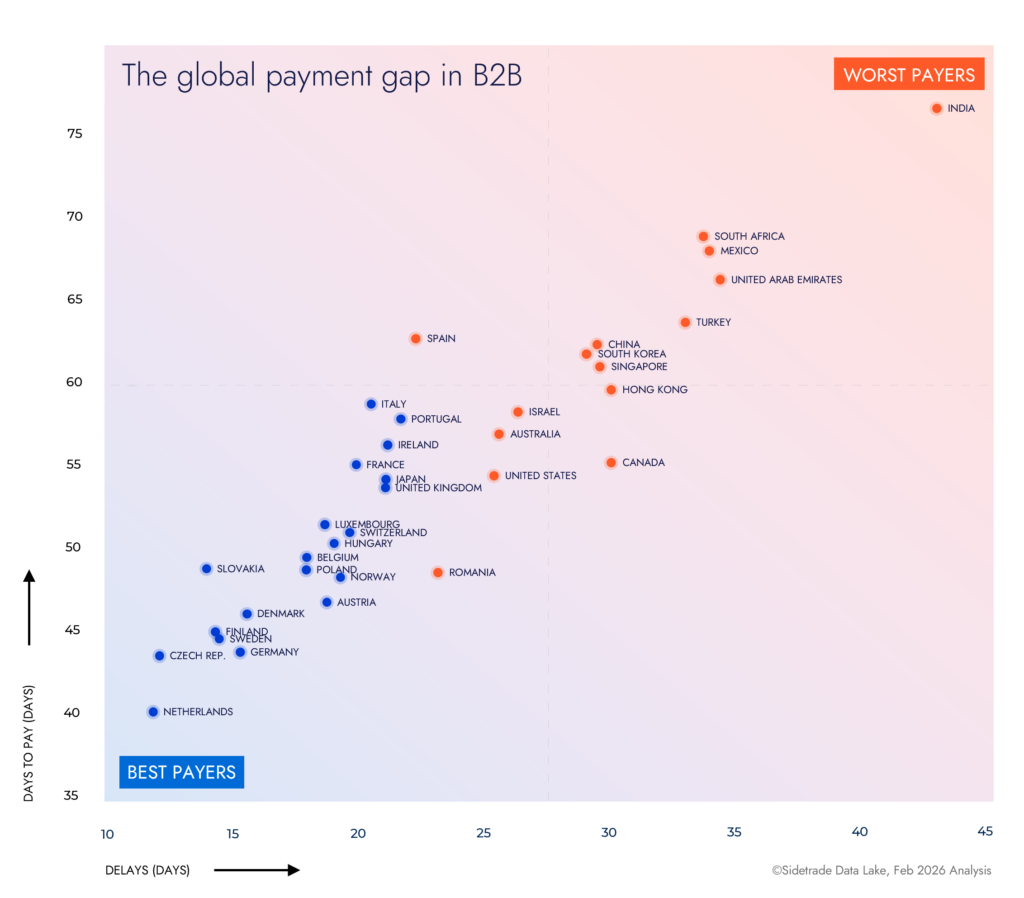

Globally, businesses took an average of 51 days to get paid in 2025, composed of:

- 32 days of contractual payment terms

- 19 days of payment delay.

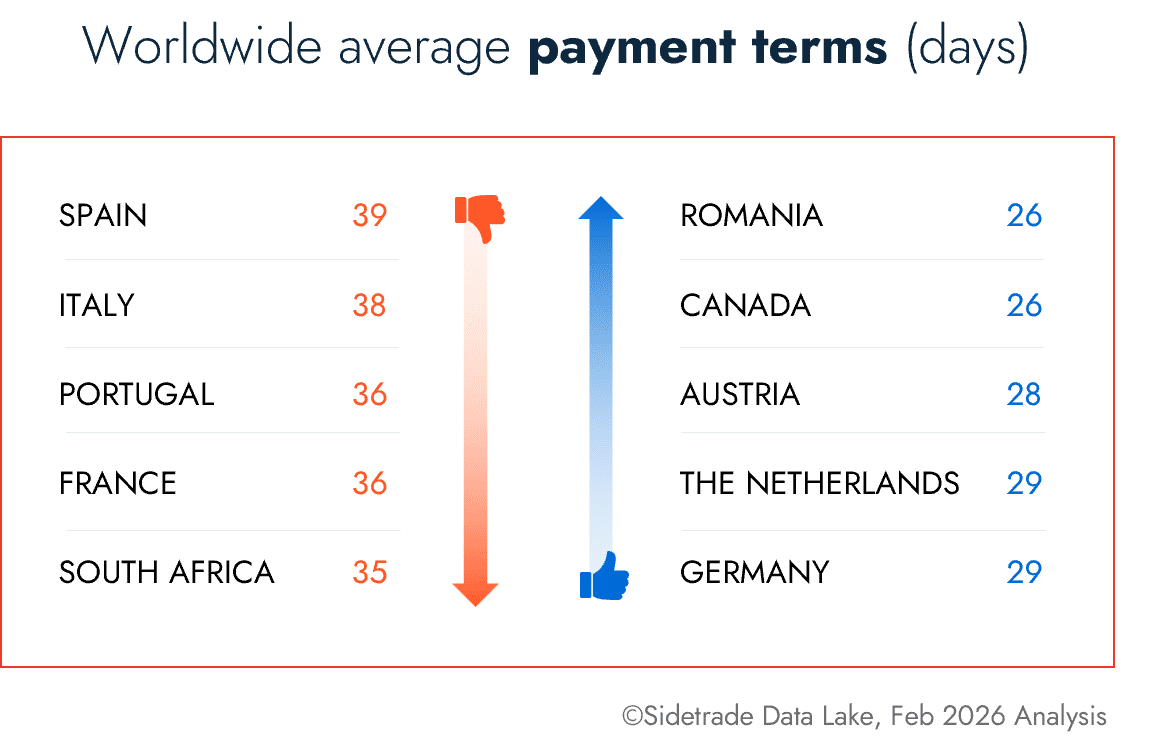

The data indicates that short commercial payment terms alone do not reliably accelerate cash generation.

Country-level disparities are significant:

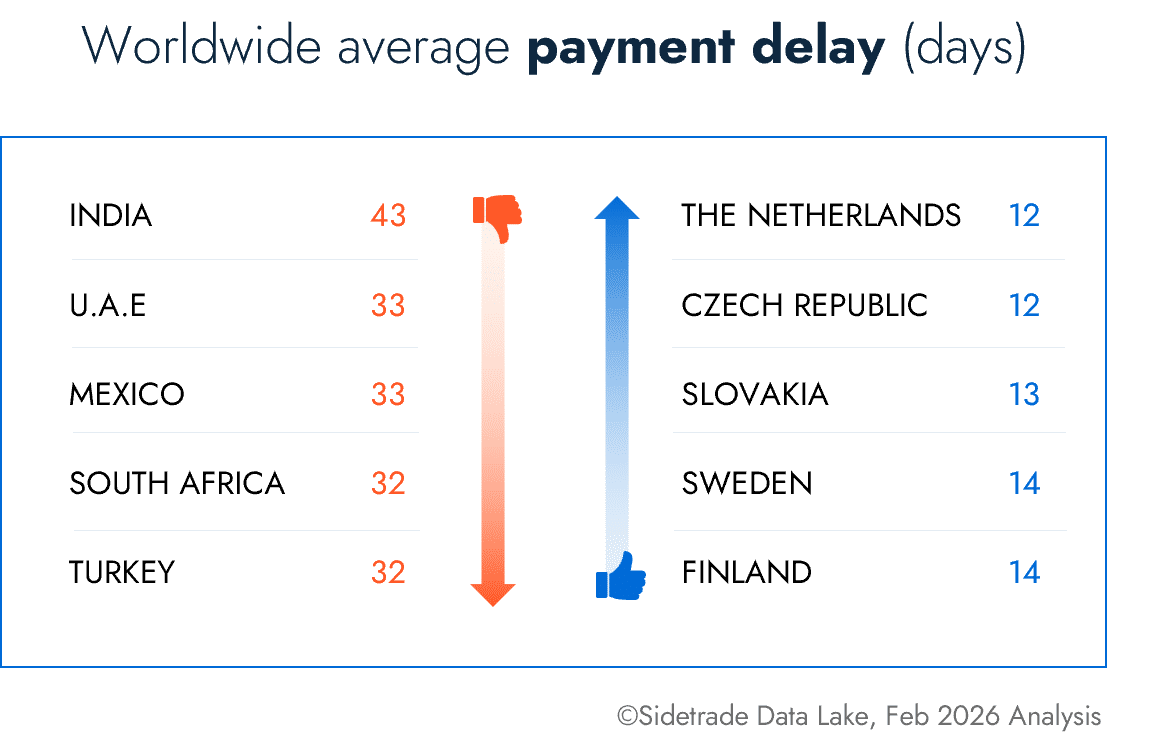

- The Netherlands sets a global benchmark at 40 days-to-pay in average, including only 12 days of delay, the lowest worldwide.

- India records an average of 77 day-to-pay, driven by 43 days of delay beyond agreed contract terms.

That 37-day gap represents cash exposure for multinational enterprises operating across regions.

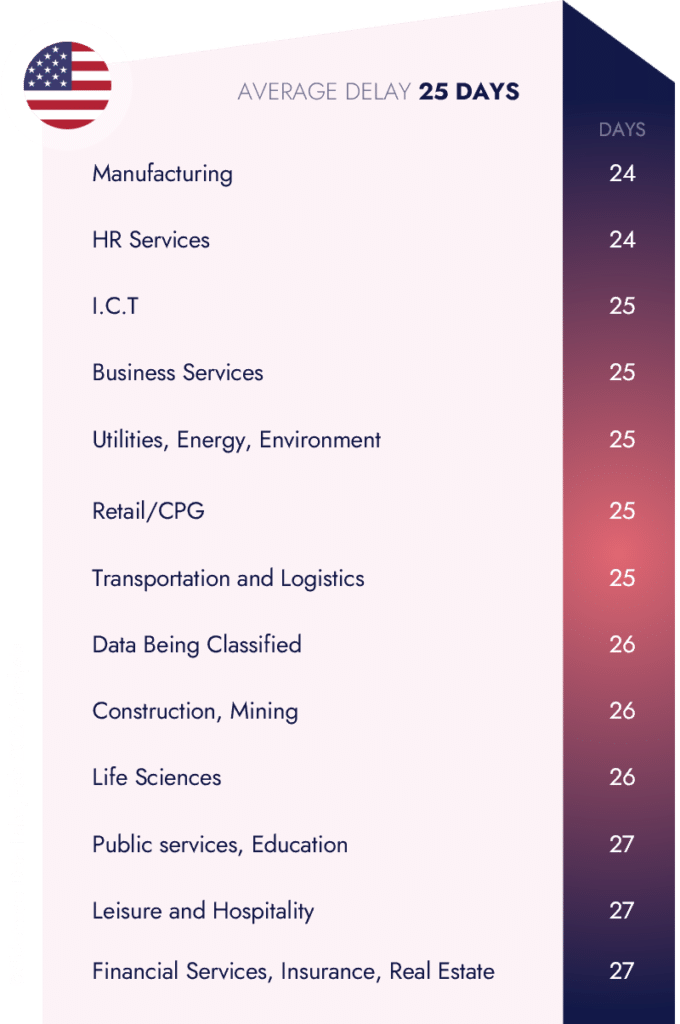

United States Snapshot: The Impact of Industry Behavior on Competitiveness

A 25-day average delay hides the United States story. On average, Financial Services, Insurance, and Real Estate operate at 57 day-to-pay with 27 days of delay, while Manufacturing and HR Services hold delays at 24 days and pay materially faster (54 days and 49 days respectively).

In this context, companies’ ability to convert revenue into cash depends first and foremost on the payment discipline specific to each industry, approval chains, and Order-to-Cash processes. Credit policies, risk segmentation, and accounts receivable management strategies must be grounded in buyers’ actual payment behavior.

United States Payment Discipline by Industry

European Payment Gap Despite Regulation

Europe outperforms the United States on payment discipline (18 vs. 29 days of delay), but EU regulation does not equal consistency. The Netherlands sets the global benchmark with Germany, Sweden, Finland, and the Czech Republic close behind (12 -15 days). Spain and parts of Southern and Eastern Europe lag, by weeks despite operating under similar legal framework.

These patterns reinforce that regulation alone does not standardize payment behavior. Control of Order-to-Cash discipline, at both the industry and enterprise levels, remains decisive.

European Payment Delay by Industry

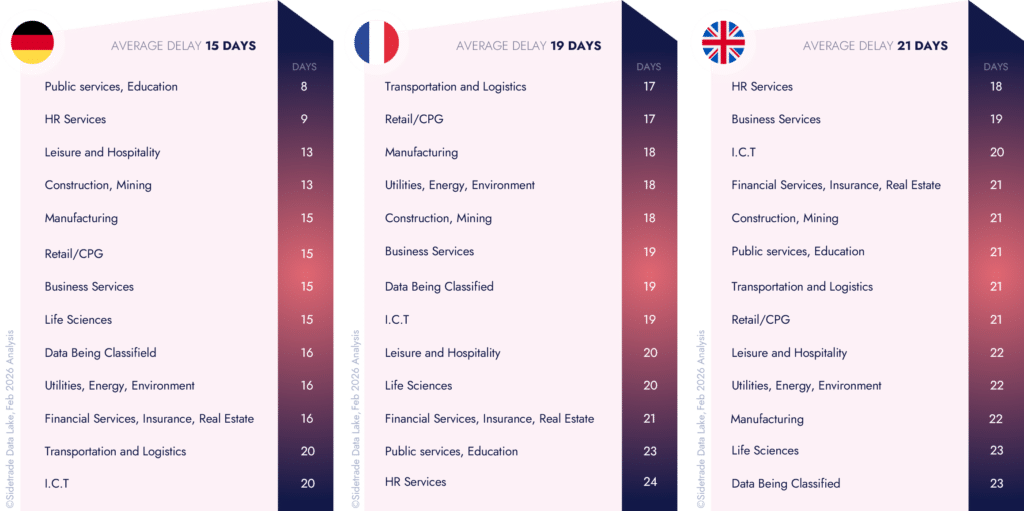

Germany averages 15 days of delay; ICT and Transport & Logistics underperform relative to the national baseline.

Within France, average payment delay stands at 19 days, but ranges from 17 days in Retail and Transport & Logistics to 24 days in HR Services.

The United Kingdom averages 21 days of delay, with Life Sciences and Manufacturing among the slowest.

Late payments are structural and consistently exceed statutory limits. For policymakers, they offer real-time insight into underlying economic pressures, said Mark Sheldon, CTO at Sidetrade. For enterprises, payment delays undermine cash forecasting, inflates accounts receivable costs, and weakens balance-sheet confidence. Renegotiating commercial terms treats the symptom. Controlling the Order-to-Cash cycle addresses the cause.

Data First, AI Second

In large enterprises, customer payment behaviors are spread across ERPs, CRMs, spreadsheets, and manual work, masking the drivers of payment delay. In 2015, Sidetrade recognized that payment signals were fragmented and largely untapped. The company evolved from an Order-to-Cash SaaS vendor to a data-centric, AI-native cash performance platform, backed by sustained investment in proprietary private-cloud infrastructure purpose-built to ingest, normalize, and analyze large-scale financial transaction data with high reliability.

We began by building the data foundation to analyze the Revenue-to-Cash, said Mark Sheldon, CTO at Sidetrade. Since 2016, the Sidetrade Data Lake has been used for training our AI models. The continuous accumulation of payment experiences, combined with proprietary infrastructure and models purpose-built for Order-to-Cash, allows our AI to learn from trillions of payment experiences. Other models, trained on broad and/or much smaller datasets, cannot reproduce that level of accuracy and outcomes in terms of financial performance.

Today, the Sidetrade Data Lake aggregates more than $8 trillion in anonymized B2B transactions, forming a continuous, payment behavior-driven dataset that reflects how enterprises pay their suppliers across regions, industries, and economic cycles.

Sidetrade’s differentiation is rooted in more than a decade of continuous investment in domain-specific data, combined with the operation of its IT infrastructure and controls over the entire AI lifecycle. From data ingestion to model deployment, the company operates without reliance on third-party MLOps platforms, ensuring long-term technological coherence and sustained operational performance.

The Importance of Financial Decision Intelligence

Static datasets do not learn. The Sidetrade Data Lake continuously captures and standardizes buyer and vendor interactions, creating the foundation required for reliable domain-specific AI at scale. Payment events are streamed in near real time Sidetrade’s AI stack, through a Kafka-based ingestion layer, persisted in a scalable analytical store, and refined through a medallion architecture that progresses data from raw to curated states. Transformations are SQL-driven, versioned, and testable, enabling reproducibility and auditability at scale.

This IT architecture allows Sidetrade to maintain consistent historical views of invoices, payments, disputes, and Order-to-Cash actions across regions, and business units. It also provides curated, production-grade feature sets to AI models supporting predictive and prescriptive use cases in collections, dispute management, credit risk, and cash forecasting.

Quality data is the foundation of AI. Without it, there’s no learning and no intelligent Order-to-Cash, said Mark Sheldon, CTO at Sidetrade.

Indeed, Aimie, Sidetrade’s agentic AI, models payment behavioral patterns that remain invisible to static or single-tenant datasets (client-bound datasets). In 2025, the Sidetrade Data Lake captured approximately 285 million invoices representing $1.7 trillion. The result is improved decision-making accross collections prioritization, dispute resolution, credit risk assessment, payment window modeling, and cash forecasting.

The discrepancies we see in the Data Lake are not marginal. They tilt the competitive balance between complex, multi-entity organizations in the same industry, strain trust between suppliers and customers, Sheldon said. In 2025, Aimie executed or recommended more than 5.1 million collection actions and supported a 49% increase in cash collection efficiency. This performance reflects a shift away from reactive workflows toward disciplined, AI data-driven operation.

Aimie, Sidetrade’s autonomous decisioning AI engine, applies probabilistic modeling, algorithmic optimization, and natural language processing to interpret payment behavior in context. This includes recurring disputes, approval bottlenecks, and region-specific execution patterns. Unlike generic models that operate on abstract assumptions, Aimie’s decisions are grounded in observed customer behavior inside live financial workflows, including exception-heavy scenarios where traditional automation breaks down. Outcomes are continuously captured and fed back into Sidetrade’s platform, allowing AI models to recalibrate against real payment results rather than static benchmarks.

Autonomous decisioning in finance doesn’t come from a model alone, Sheldon concluded. It comes from the scale, structure, and governance of the data behind it. Aimie is trained on anonymized, real-world B2B payment behavior, using Order-to-Cash-specific models, deployed within a governed and private environment. That data foundation is what allows our autonomous agents to prioritize collections, surface disputes, flag emerging risk, and forecast cash with a level of accuracy and operational efficiency that generic AI agents cannot match.

With Sidetrade, enterprises are transitioning from static, rules-based automation to autonomous cash flow decisioning powered by adaptive AI. In volatile markets, where payment behavior shifts rapidly across countries and industries, predefined workflows fail to keep pace. As regional and industry patterns diverge, effective decisions depend on AI systems that learn continuously and act in real time.

Olivier Novasque, CEO and Founder of Sidetrade, commented:

After a challenging first half marked by weaker bookings, driven by both the macroeconomic environment and an exceptionally unfavorable comparison base effect following the record first half of 2024, Sidetrade gradually regained consistent commercial momentum in the second half of the year. This momentum is expected to continue and potentially accelerate over the coming quarters.

The launch of Sidetrade’s AI Cash Collection Agent, fully autonomous and scheduled for commercial release in the first quarter of 2026, has already secured pre-orders from four multinational companies. Currently in the qualification phase and undergoing advanced testing, the planned deployment into live production of 15 agents by the end of the first quarter of 2026 will enable the qualification of tens of thousands of invoices involving thousands of B2B debtors, without human intervention. A world first in the Order-to-Cash industry. In the context of the agentic AI transformation, reshaping entire sectors of the economy and redefining the relationship between humans and work, the launch of this autonomous Agent marks only the first phase of Sidetrade’s AI strategy. An even more disruptive roadmap will be unveiled shortly.

From a business perspective, Sidetrade sustained its growth trajectory in 2025, with revenue up 14% including 20% growth in subscriptions at constant currency. This performance, particularly strong in subscriptions, reflects an equal contribution from organic growth of 10% and the relevance and effective execution of our external growth strategy, also contributing 10%, driven by the successive acquisitions of SHS Viveon in Germany and ezyCollect in Asia-Pacific. The latter represents a new growth lever for the Group and is expected to accelerate the deployment of our agentic AI within the SME segment, which has a structurally strong demand for scalable, cost-efficient resources.

Over the past four years, Sidetrade has nearly doubled in size, reaching €36.8 million in revenue in 2022, and has become a global player, with 71% of revenue generated internationally. The Group now serves all market segments, from small businesses to multinational corporations. Beyond the financial metrics, the AI strategy initiated in 2016 continues to deliver tangible results and is expected to accelerate further in 2026, making the next three years particularly exciting.

Gradual Recovery in Commercial Momentum in H2 2025

Sidetrade closed Q4 2025 with new Annual Contract Value (ACV) of €3.25 million, down by 14% year over year compared with Q4 2024. This performance included €1.3 million in new Annual Recurring Revenue (ARR) subscriptions and €1.95 million in services bookings.

After a first half marked by a 21% decline, driven by a challenging economic environment and a particularly demanding comparison base (with H1 2024 representing an all-time record), booking activity stabilized in the second half of 2025. For H2 2025, ACV bookings totaled €5.16 million, compared with €5.31 million in H2 2024, representing a limited decrease of 2.8%. This comprised €1.88 million in new ARR subscriptions and €3.28 million in services bookings.

…offsetting the full-year decline in 2025

For full-year 2025, ACV bookings totaled €11.04 million, compared with €12.73 million in 2024, including €4.32 million in New ARR subscriptions and €6.71 million in services bookings. The improvement observed in the second half reduced the contraction from 21% in the first half to 13% for the year as a whole. Beyond the macroeconomic headwinds, which prompted increased caution among large enterprise customers, the level of bookings achieved in 2025 (€11.04 million) remained close to that of 2023 (€11.3 million), the reference year preceding the all-time record set in 2024.

Strong Revenue Growth in 2025: 14% Overall, Including 20% Growth in SaaS Subscriptions at Constant Currency (Up 12% and 18%, Respectively, on a Reported Basis)

| Sidetrade (€m) |

2025 | 2024 | Change |

| SaaS subscriptions | 53.5 | 45.5 | +18% |

| Revenue | 61.4 | 55.0 | +12% |

2025 figures are based on unaudited consolidated data.

Sidetrade delivered sustained growth in 2025, with consolidated revenue of €61.4 million, up 14% at constant currency (12% on a reported basis). SaaS subscription revenue for 2025 reached €53.5 million, representing growth of 20% at constant currency (18% on a reported basis). On a like-for-like basis (excluding the consolidation of SHS Viveon in H2 2024 and ezyCollect in Q4 2025), organic growth at constant currency amounted to 10% in 2025, underscoring the resilience of Sidetrade’s recurring revenue base in a volatile macroeconomic environment.

The Group’s enterprise-focused commercial strategy continues to deliver results. Subscriptions from companies generating more than €2.5 billion in annual revenue increased by 23% and accounted for 54% of the Enterprise portfolio. This performance confirms the relevance of Sidetrade’s positioning with multinational organizations.

International expansion remains a key growth driver. In 2025, 71% of revenue was generated outside France, reflecting Sidetrade’s expanding geographic footprint and global scale. Within this dynamic, North America recorded growth of 25% at constant currency, becoming the Group’s leading region and representing 30% of total revenue.

In FY 2025, ezyCollect contributed €2.2 million in revenue following its integration on October 1, 2025. Its activities, now reported within the Asia-Pacific region (Australia, New Zealand, and the Philippines), represented 13% of Group revenue in the fourth quarter of 2025. This newly established region is emerging as an additional growth engine for the Group.

Autonomous AI Agent: Four Multinationals in the Deployment Phase

Sidetrade has reached a technological threshold by equipping Aimie with agentic capabilities. This marks the first building block in an architecture of specialized AI Agents designed to collaborate and industrialize execution across the Order-to-Cash cycle.

In May 2025, Aimie was introduced as the first autonomous, interactive AI Cash Collection Agent, capable of executing dunning actions and interacting with humans by phone. This agentic AI has since evolved from intelligent automation and conversational assistance to closed-loop execution with controlled autonomy. Within a defined governance framework, Aimie can leverage transactional and behavioral signals from the Sidetrade Data Lake to call customers at the optimal time, qualify an outstanding invoice with the debtor, and then deliver a contextualized transcript into the Sidetrade platform providing traceability and faster execution for customer-facing teams.

For large organizations, maintaining control over rules and ensuring traceability of actions, under supervision aligned with credit policies and compliance requirements, are prerequisites. For finance teams, the objective is to increase productivity and systematize the use of phone calls, which is recognized as the most effective channel in cash collection. The ultimate goal is to accelerate cash generation and standardize execution at scale.

During the pre-launch phase, four multinationals chose to evaluate the Aimie Agent in real-world conditions. The objective is to move 15 autonomous Cash Collection Agents into production by the end of the first quarter of 2026, enabling these multinationals to scale their collections operations, reaching thousands of debtors and qualifying tens of thousands of invoices without human intervention, a world first in corporate finance.

ISO 27001 Certification Renewed and SOC Type II Reports Published

Sidetrade strengthens its trust foundation for global enterprise customers with the renewal of its ISO/IEC 27001 certification, aligned with the latest version of the norm (2022), and the publication of SOC 1 Type II and SOC 2 Type II reports.

These certifications provide auditable proof of the maturity of Sidetrade’s controls, governance, and risk management, as expected by IT, Risk, and Procurement teams within large organizations. The result: reduced friction during security due diligence, shorter validation cycles, and the ability to deploy solutions at scale across multi-entity and multi-country environments without compromising operational control.

Leading ESG Performance Recognized by EthiFinance and EcoVadis

In 2025, Sidetrade validated the maturity of its ESG approach through two benchmark assessments:

- EthiFinance awarded Sidetrade a Gold medal with a score of 79/100, an increase of 6 points vs. 2024.

- EcoVadis ranked Sidetrade in the top 15% worldwide and in the “Advanced” category for its sector, above industry standards.

These recognitions serve as valuable external proof points for enterprise customers, partners, and investors. They reflect the continued strengthening of ESG policies, controls, and performance indicators, and reinforce Sidetrade’s credibility in procurement, risk, and compliance processes at a time when CSRD requirements demand more auditable and comparable reporting.

Sidetrade enters the 2026 fiscal year with confidence, a clear strategic vision, and the resources required to deliver on its ambitions.

The SOC (System and Organization Controls) reporting framework provides independent assurance on the design and operating effectiveness of controls over time. Following audits conducted by EY France, Sidetrade received SOC 1® Type II and SOC 2® Type II reports with an unmodified auditor’s opinion, confirming that its internal controls were suitably designed and operated effectively throughout the audit period.

Notably, these results were achieved while Sidetrade integrated acquisitions, expanded its global footprint, and introduced new agentic AI capabilities, indicating a level of control maturity capable of absorbing structural and technological change without degradation.

In parallel, the ISO 27001:2022 full recertification confirms the continued effectiveness of Sidetrade’s Information Security Management System (ISMS), aligned with international best practices, with no material nonconformities recorded. Sidetrade has been ISO 27001 certified since 2019.

According to Laurent Pontier, Sidetrade CTO Chief of Staff:Achieving these SOC1, SOC2 and ISO 27001 results, while scaling rapidly and introducing new agentic capabilities required a disciplined, cross-functional operating model, and I’m incredibly proud of the teams involved. Security and compliance at Sidetrade are designed as proactive control layers, developed to remain robust as our products, AI architecture and market conditions evolve.

A trust signal for regulated and US-based enterprises

For enterprises operating under Sarbanes-Oxley (SOX) or equivalent regulatory regimes, SOC 1® Type II remains a core assurance mechanism, confirming that software supporting financial processes is governed by reliable and consistently applied, auditable controls. SOC 2® Type II, increasingly required by US enterprises during vendor due diligence, provides independent assurance over security, availability, and confidentiality controls across infrastructure and development operations.

AI at scale cannot be treated as an experiment. It must be governed, observable, and resilient by design, said Pontier. The SOC reports reflect how we design our AI platform to meet the control standards expected in SOX-regulated environments. Trust is not declared. It is demonstrated, year after year.

Issued by EY CertifyPoint, Sidetrade’s latest ISO 27001 recertification adds a complementary layer of assurance, signaling a mature and embedded approach to information security governance. In 2025 Sidetrade transitioned to the latest version of the norm: ISO/IEC 27001:2022.

AI platform and data sovereignty built into security framework

With AI central to Sidetrade’s platform, the company’s ISO/IEC 27001:2022 certified ISMS scope explicitly includes its artificial intelligence systems, including Aimie, its agentic AI, alongside its core Order-to-Cash applications and services.

Sidetrade’s SOC 1® Type II report covers controls relevant to customer-facing applications supporting financial processing, while the SOC 2® Type II report covers the organization’s controls across people, processes and technology, including operational processes and its software development lifecycle.

While SOC reports do not provide AI-specific assurance, AI capabilities are developed and operated under the same standard development and security controls applied across Sidetrade’s platform.

Since its inception, Sidetrade has taken a deliberate approach to sovereignty by operating its infrastructure, AI models and payment data within a controlled environment. This ensures full segregation of customer data and keeps it within, secure, controlled boundaries. The approach is designed to meet the highest standards of privacy, security and regulation, including GDPR.

Preparing for the next regulatory wave

The audit outcomes also support Sidetrade’s preparation for emerging regulatory frameworks, including the EU AI Act, which is expected to increase formal expectations around risk management, transparency, and control design for AI companies such as Sidetrade.

While SOC reports are distributed under NDA and ISO 27001 certification applies strictly to the defined ISMS scope, the combination remains a key trust signal for enterprises evaluating AI vendors in mission-critical financial workflows.

As businesses accelerate AI adoption while tightening vendor oversight, Sidetrade’s latest audit outcomes position it among AI providers treating security assurance as continuous operational discipline rather than a marketing milestone.

Find out more about Sidetrade’s commitment to effective governance and Corporate Social Responsibility here.

Sidetrade received a Gold Medal with a score of 79/100 in the most recent rating published on December 2, 2025, by EthiFinance, the extra-financial rating agency specializing in listed European SMEs. The assessment confirms a consistent upward trajectory. Sidetrade improved from 62/100 in 2023 to 73/100 in 2024, then to 79 out of 100 under EthiFinance’s new 2025 ESG rating framework. This progression reflects the strength of the company’s operational discipline across governance, social responsibility, and environmental management.

EthiFinance highlights the Group’s strong performance in human rights, diversity and inclusion, responsible procurement, and transparency in extra-financial reporting, as well as its alignment with emerging European regulatory requirements, including the CSRD.

EcoVadis, the world’s most trusted business sustainability rater, confirmed the strength of Sidetrade’s ESG profile with a score of 70/100 and Silver Medal, placing the Group among the top 15% worldwide. Sidetrade ranks in the “Advanced” category for its industry. This level is well above the industry norms, where most companies cluster between 45 and 60/100 and only a limited number reach the “Advanced” tier.

EcoVadis also recognized Sidetrade’s advanced management systems across labor and human rights, ethics, and sustainable procurement, and reported no findings in third-party risk and compliance databases. Sidetrade’s results position the Group among the strongest performers in the sector, supported by a mature ethics framework, robust social practices, responsible procurement program, and structured environmental management.

Philippe Gangneux, Chief Financial Officer and CSR Ambassador at Sidetrade commented: These ratings reflect the dedication of our teams and the consistency of our ESG ambition. We are proud to see our sustained progress recognized across multiple years of independent assessment. This momentum strengthens our resolve to build a resilient, trusted, and responsible AI company for the long term.

Learn more about Sidetrade’s CSR commitments.

- Annual Revenue for 2025Tuesday 20 January 2026

after stock market closes - Annual Results for 2025Monday 30 March 2026

after stock market closes - First Quarter Revenue for 2026Tuesday 14 April 2026

after stock market closes - Annual Shareholder General Meeting 2026Thursday 18 June 2025

from 11:00am (CEST) - First Half Year Revenue for 2026Tuesday 21 July 2026

after stock market closes - First Half Year Results for 2026Tuesday 22 September 2026

after stock market closes - Third Quarter Revenue for 2026Tuesday 20 October 2026

after stock market closes - Annual Revenue for 2026Tuesday 26 January 2027

after stock market closes

Belgium and Switzerland consistently rank near the bottom of the European league table for payment punctuality, a growing challenge for finance teams in the region as they battle with market volatility. NX Partners will act as Sidetrade’s implementation partner in the Benelux region (Belgium, the Netherlands, Luxembourg) and Switzerland, embedding the company’s AI-driven Order-to-Cash platform into clients’ finance-transformation programs.

CFOs today are being asked to deliver stability in unstable markets. Our role is to stand shoulder to shoulder with them, said Henri Vandermeersch, Managing Director, NX Partners. So, we’re selective about the partners we work with, choosing only best-in-class solutions. Sidetrade’s technology stands out. Their agentic AI converts complexity into foresight, giving finance leaders the capacity they need to move faster, with greater resilience.

At the core of the alliance is Aimie, Sidetrade’s agentic AI that masters Order-to-Cash processes, recommends follow-up actions, and acts autonomously on cash collection freeing finance teams to focus on higher-value work. Aimie learns continuously from the industry’s most unique Data Lake, leveraging more than $7.7 trillion in B2B payment behaviors. Acting as an extension of Sidetrade’s professional services, NX Partners will deploy Aimie as a new co-worker, driving new team capacities for their customers.

Through this partnership, Sidetrade enhances its presence in Benelux and Switzerland, said Jean-Claude Charpenet, VP Sales Europe, Sidetrade. By partnering with an advisor that understands the CFO mindset in Continental Western Europe, we will bring the power of agentic AI to enterprise finance, empowering CFOs with a new co-worker. NX Partners and Aimie are a great match to help organizations protect their working capital and sustain growth.

Announced on October 13, 2025 (cf. press release), the transaction marks another milestone in Sidetrade’s international growth strategy. Already established in Europe and North America, Sidetrade is now expanding its footprint into Asia-Pacific. The addition of ezyCollect provides the Group with a new growth engine in a highly dynamic, fast-growing market.

The transaction values ezyCollect at €37.3 million (A$66.5 million), including €34.7 million (A$61.9 million) paid in cash at closing and €2.6 million (A$4.6 million) in Sidetrade free shares, designed to retain the company’s two founders and key team members for a minimum of three years. In addition, the founders may be eligible for an earn-out of up to €5.6 million (A$10 million), based on ezyCollect’s Annual Recurring Revenue (ARR) growth through the end of 2028. This earnout is currently estimated at approximately €3.3 million (A$6 million) and would be settled equally in Sidetrade shares and cash.

Sidetrade also plans to align long-term incentives for selected ezyCollect key employees by granting additional Sidetrade shares over the coming years as part of a dedicated equity plan.

The acquisition is financed with Sidetrade’s cash on hand and a €25 million long-term credit facility with an interest rate of approximately 3.1%, fully hedged. This structure allows the Group to preserve liquidity while maintaining flexibility for future M&A initiatives.

The transaction will be consolidated retroactively as of October 1, 2025. The addition of ezyCollect strengthens Sidetrade’s mission to democratize its agentic AI platform, Aimie, now set to transform financial performance for mid-market and large enterprises alike.

Sidetrade was advised by King & Spalding LLP (Laurent Bensaid, Julien Vicariot, and Carla De Checchi). ezyCollect was advised by AGC Partners, a US-based investment bank, and Thomson Geer, a leading Australian law firm.