Sidetrade, the Order-to-Cash AI company, today released new global payment data showing that late payments now account for 37% of the payment cycle. The findings come from the latest analysis of the Sidetrade Data Lake, one of the world’s most comprehensive anonymized data repositories focused on payment behavior across the Order-to-Cash cycle. Based on $8 trillion+ in B2B transactions from more than 42 million buying companies, the data shows that contractual payment terms do not determine when companies get paid. What matters instead is how invoices are managed by suppliers.

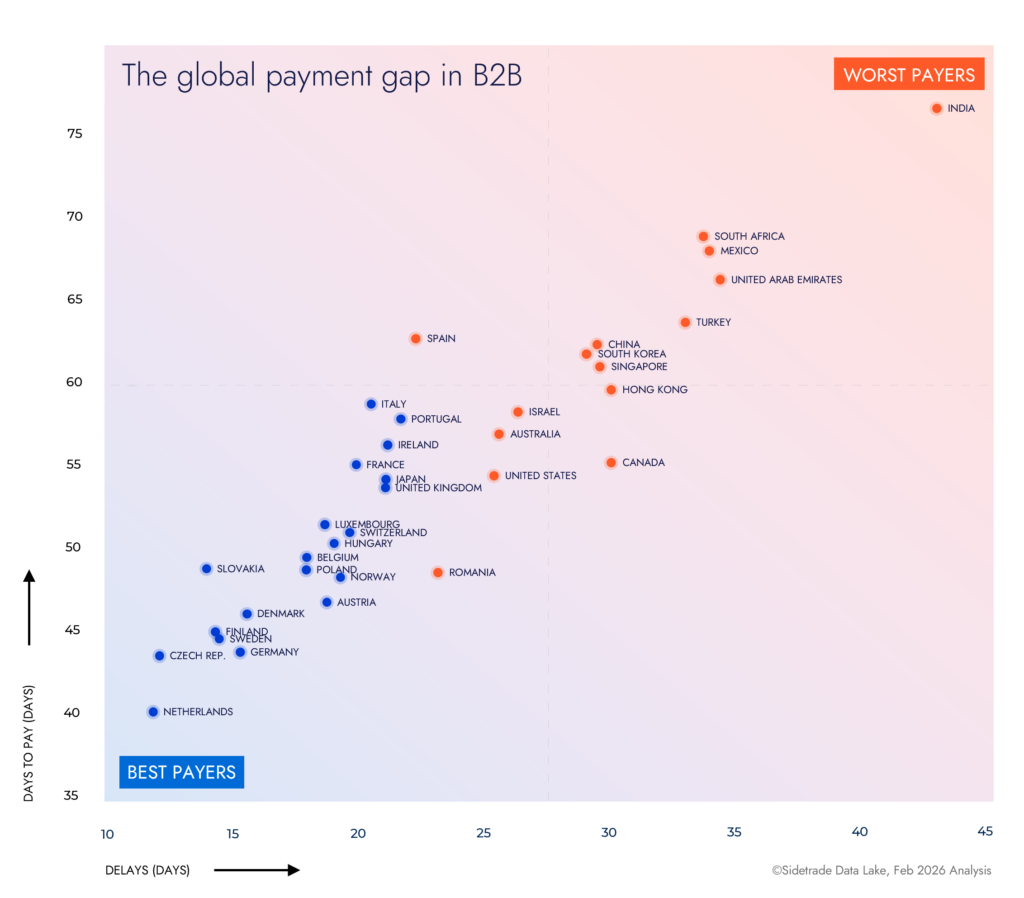

The Global Payment Gap in B2B

In a volatile macroeconomic environment, B2B payment behavior reveals buyers’ efforts to optimize their working capital, along with the resulting commercial tensions and cash-flow risks that follow.

The Sidetrade Data Lake shows 37% of the days-to-pay cycle now happens after the payment due date. This shift increases uncertainty in suppliers’ cash-flow forecasting and raises the stakes in working capital management.

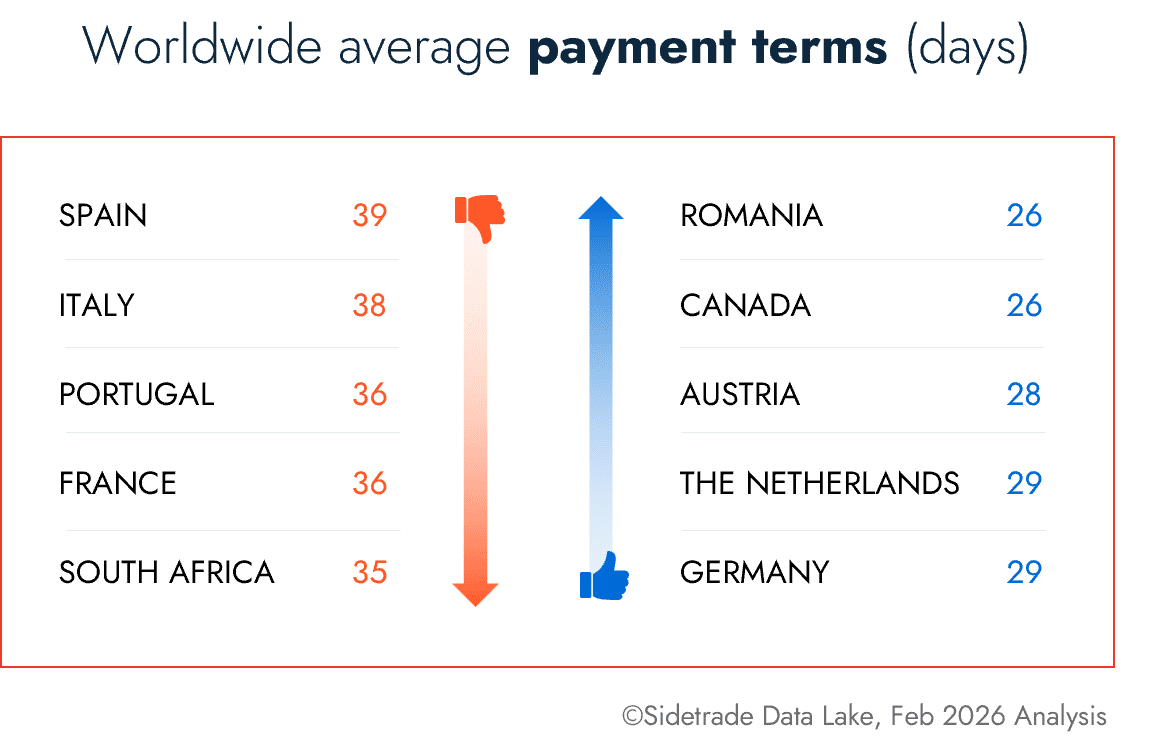

Regional Discipline, Not Terms, Explains Who Gets Paid Faster

Globally, businesses took an average of 51 days to get paid in 2025, composed of:

- 32 days of contractual payment terms

- 19 days of payment delay.

The data indicates that short commercial payment terms alone do not reliably accelerate cash generation.

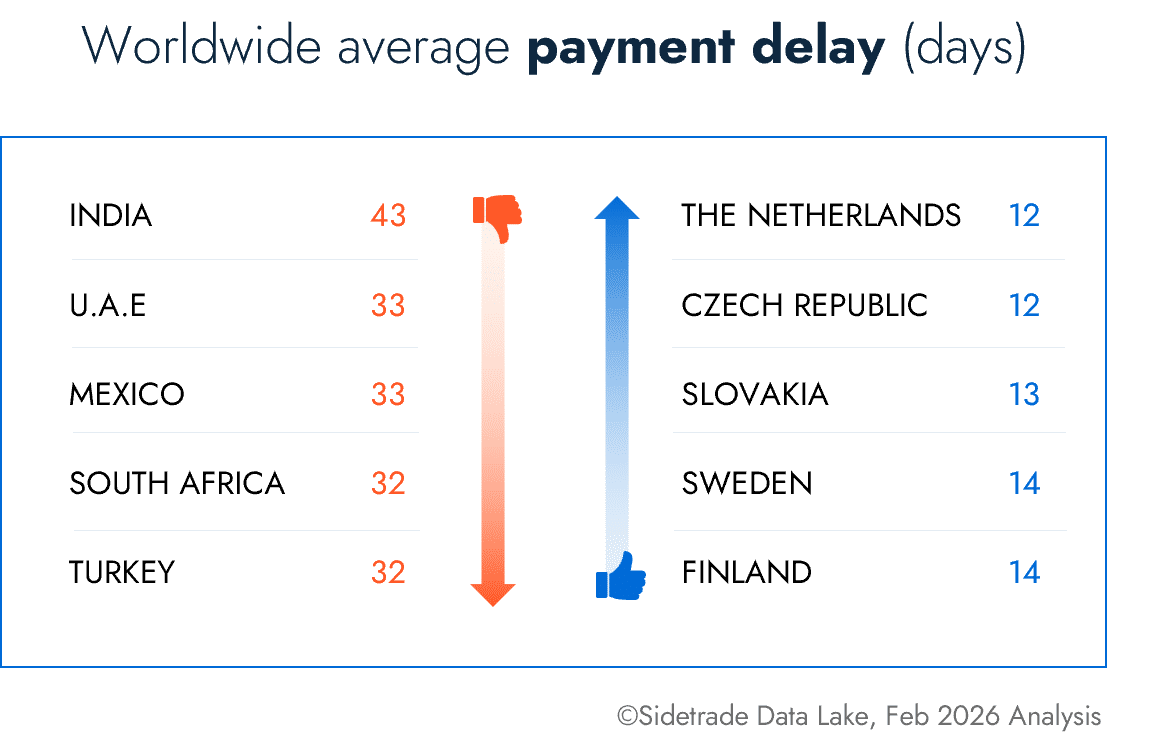

Country-level disparities are significant:

- The Netherlands sets a global benchmark at 40 days-to-pay in average, including only 12 days of delay, the lowest worldwide.

- India records an average of 77 day-to-pay, driven by 43 days of delay beyond agreed contract terms.

That 37-day gap represents cash exposure for multinational enterprises operating across regions.

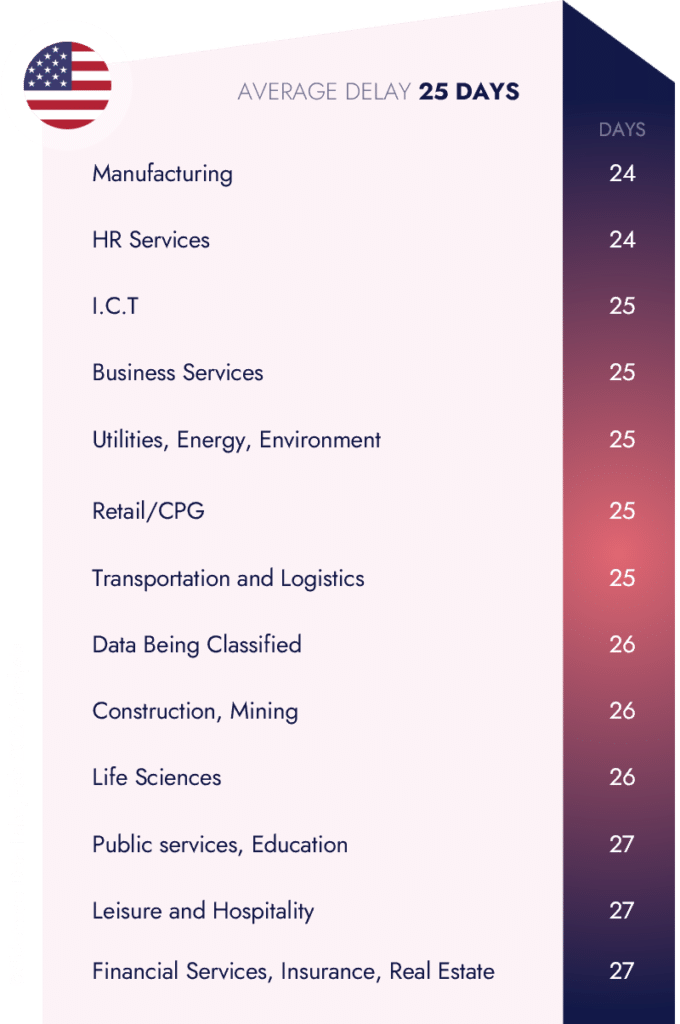

United States Snapshot: The Impact of Industry Behavior on Competitiveness

A 25-day average delay hides the United States story. On average, Financial Services, Insurance, and Real Estate operate at 57 day-to-pay with 27 days of delay, while Manufacturing and HR Services hold delays at 24 days and pay materially faster (54 days and 49 days respectively).

In this context, companies’ ability to convert revenue into cash depends first and foremost on the payment discipline specific to each industry, approval chains, and Order-to-Cash processes. Credit policies, risk segmentation, and accounts receivable management strategies must be grounded in buyers’ actual payment behavior.

United States Payment Discipline by Industry

European Payment Gap Despite Regulation

Europe outperforms the United States on payment discipline (18 vs. 29 days of delay), but EU regulation does not equal consistency. The Netherlands sets the global benchmark with Germany, Sweden, Finland, and the Czech Republic close behind (12 -15 days). Spain and parts of Southern and Eastern Europe lag, by weeks despite operating under similar legal framework.

These patterns reinforce that regulation alone does not standardize payment behavior. Control of Order-to-Cash discipline, at both the industry and enterprise levels, remains decisive.

European Payment Delay by Industry

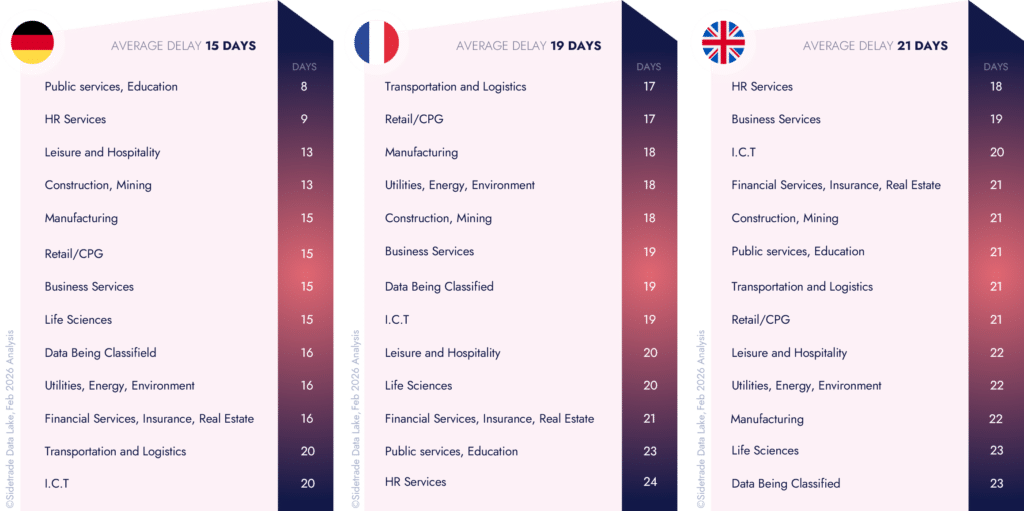

Germany averages 15 days of delay; ICT and Transport & Logistics underperform relative to the national baseline.

Within France, average payment delay stands at 19 days, but ranges from 17 days in Retail and Transport & Logistics to 24 days in HR Services.

The United Kingdom averages 21 days of delay, with Life Sciences and Manufacturing among the slowest.

Late payments are structural and consistently exceed statutory limits. For policymakers, they offer real-time insight into underlying economic pressures, said Mark Sheldon, CTO at Sidetrade. For enterprises, payment delays undermine cash forecasting, inflates accounts receivable costs, and weakens balance-sheet confidence. Renegotiating commercial terms treats the symptom. Controlling the Order-to-Cash cycle addresses the cause.

Data First, AI Second

In large enterprises, customer payment behaviors are spread across ERPs, CRMs, spreadsheets, and manual work, masking the drivers of payment delay. In 2015, Sidetrade recognized that payment signals were fragmented and largely untapped. The company evolved from an Order-to-Cash SaaS vendor to a data-centric, AI-native cash performance platform, backed by sustained investment in proprietary private-cloud infrastructure purpose-built to ingest, normalize, and analyze large-scale financial transaction data with high reliability.

We began by building the data foundation to analyze the Revenue-to-Cash, said Mark Sheldon, CTO at Sidetrade. Since 2016, the Sidetrade Data Lake has been used for training our AI models. The continuous accumulation of payment experiences, combined with proprietary infrastructure and models purpose-built for Order-to-Cash, allows our AI to learn from trillions of payment experiences. Other models, trained on broad and/or much smaller datasets, cannot reproduce that level of accuracy and outcomes in terms of financial performance.

Today, the Sidetrade Data Lake aggregates more than $8 trillion in anonymized B2B transactions, forming a continuous, payment behavior-driven dataset that reflects how enterprises pay their suppliers across regions, industries, and economic cycles.

Sidetrade’s differentiation is rooted in more than a decade of continuous investment in domain-specific data, combined with the operation of its IT infrastructure and controls over the entire AI lifecycle. From data ingestion to model deployment, the company operates without reliance on third-party MLOps platforms, ensuring long-term technological coherence and sustained operational performance.

The Importance of Financial Decision Intelligence

Static datasets do not learn. The Sidetrade Data Lake continuously captures and standardizes buyer and vendor interactions, creating the foundation required for reliable domain-specific AI at scale. Payment events are streamed in near real time Sidetrade’s AI stack, through a Kafka-based ingestion layer, persisted in a scalable analytical store, and refined through a medallion architecture that progresses data from raw to curated states. Transformations are SQL-driven, versioned, and testable, enabling reproducibility and auditability at scale.

This IT architecture allows Sidetrade to maintain consistent historical views of invoices, payments, disputes, and Order-to-Cash actions across regions, and business units. It also provides curated, production-grade feature sets to AI models supporting predictive and prescriptive use cases in collections, dispute management, credit risk, and cash forecasting.

Quality data is the foundation of AI. Without it, there’s no learning and no intelligent Order-to-Cash, said Mark Sheldon, CTO at Sidetrade.

Indeed, Aimie, Sidetrade’s agentic AI, models payment behavioral patterns that remain invisible to static or single-tenant datasets (client-bound datasets). In 2025, the Sidetrade Data Lake captured approximately 285 million invoices representing $1.7 trillion. The result is improved decision-making accross collections prioritization, dispute resolution, credit risk assessment, payment window modeling, and cash forecasting.

The discrepancies we see in the Data Lake are not marginal. They tilt the competitive balance between complex, multi-entity organizations in the same industry, strain trust between suppliers and customers, Sheldon said. In 2025, Aimie executed or recommended more than 5.1 million collection actions and supported a 49% increase in cash collection efficiency. This performance reflects a shift away from reactive workflows toward disciplined, AI data-driven operation.

Aimie, Sidetrade’s autonomous decisioning AI engine, applies probabilistic modeling, algorithmic optimization, and natural language processing to interpret payment behavior in context. This includes recurring disputes, approval bottlenecks, and region-specific execution patterns. Unlike generic models that operate on abstract assumptions, Aimie’s decisions are grounded in observed customer behavior inside live financial workflows, including exception-heavy scenarios where traditional automation breaks down. Outcomes are continuously captured and fed back into Sidetrade’s platform, allowing AI models to recalibrate against real payment results rather than static benchmarks.

Autonomous decisioning in finance doesn’t come from a model alone, Sheldon concluded. It comes from the scale, structure, and governance of the data behind it. Aimie is trained on anonymized, real-world B2B payment behavior, using Order-to-Cash-specific models, deployed within a governed and private environment. That data foundation is what allows our autonomous agents to prioritize collections, surface disputes, flag emerging risk, and forecast cash with a level of accuracy and operational efficiency that generic AI agents cannot match.

With Sidetrade, enterprises are transitioning from static, rules-based automation to autonomous cash flow decisioning powered by adaptive AI. In volatile markets, where payment behavior shifts rapidly across countries and industries, predefined workflows fail to keep pace. As regional and industry patterns diverge, effective decisions depend on AI systems that learn continuously and act in real time.